AI for Insurance Brokers: How Regional Firms Can Compete with National Players

The insurance brokerage landscape has long been dominated by size advantages—national brokers leverage vast resources and sophisticated technology platforms to outmaneuver smaller competitors. For decades, regional brokers have watched as larger firms deployed proprietary systems, hired armies of data scientists, and built technology infrastructure that seemed impossibly out of reach for mid-market agencies.

However, AI for insurance brokers is fundamentally changing this dynamic by democratizing access to analytical capabilities that were once exclusive to large organizations. For the first time in decades, regional brokers have technology that can level the playing field, allowing them to compete on speed, accuracy, and sophisticated risk analysis. The transformation isn't just incremental—it's revolutionary, reshaping the competitive landscape in ways that favor agility and specialization over sheer size.

The Historical Disadvantage

To understand the significance of this shift, it's important to recognize the challenges regional brokers have faced. National brokerages invested hundreds of millions in technology platforms, creating moats around their businesses that seemed insurmountable. They could process applications faster, analyze risk more comprehensively, and provide clients with data-driven insights that smaller competitors simply couldn't match.

Regional brokers compensated with relationship-building and local expertise, but these advantages were gradually eroding as clients increasingly demanded the sophisticated analytics and rapid response times that only large firms could provide. The choice seemed binary: grow through acquisition to compete with national players, or accept a diminishing market position serving only the smallest accounts that national firms overlooked.

AI has shattered this false dichotomy.

Amplifying Natural Advantages

Regional brokers have always possessed inherent advantages: deep local market knowledge, personalized service, and nimble decision-making. AI amplifies these strengths rather than replacing them. While national brokers must navigate complex bureaucracies to implement new systems or adjust their approach to emerging risks, regional firms can implement AI solutions quickly and customize them to their specific market niches.

Consider a regional broker specializing in manufacturing risks in the industrial Midwest. They understand the specific challenges facing local manufacturers—the supply chain vulnerabilities, the workforce dynamics, the regulatory environment, and the seasonal risk patterns unique to their region. When they deploy AI tools, they can train these systems on their specific market knowledge, creating insights that generic national platforms cannot match.

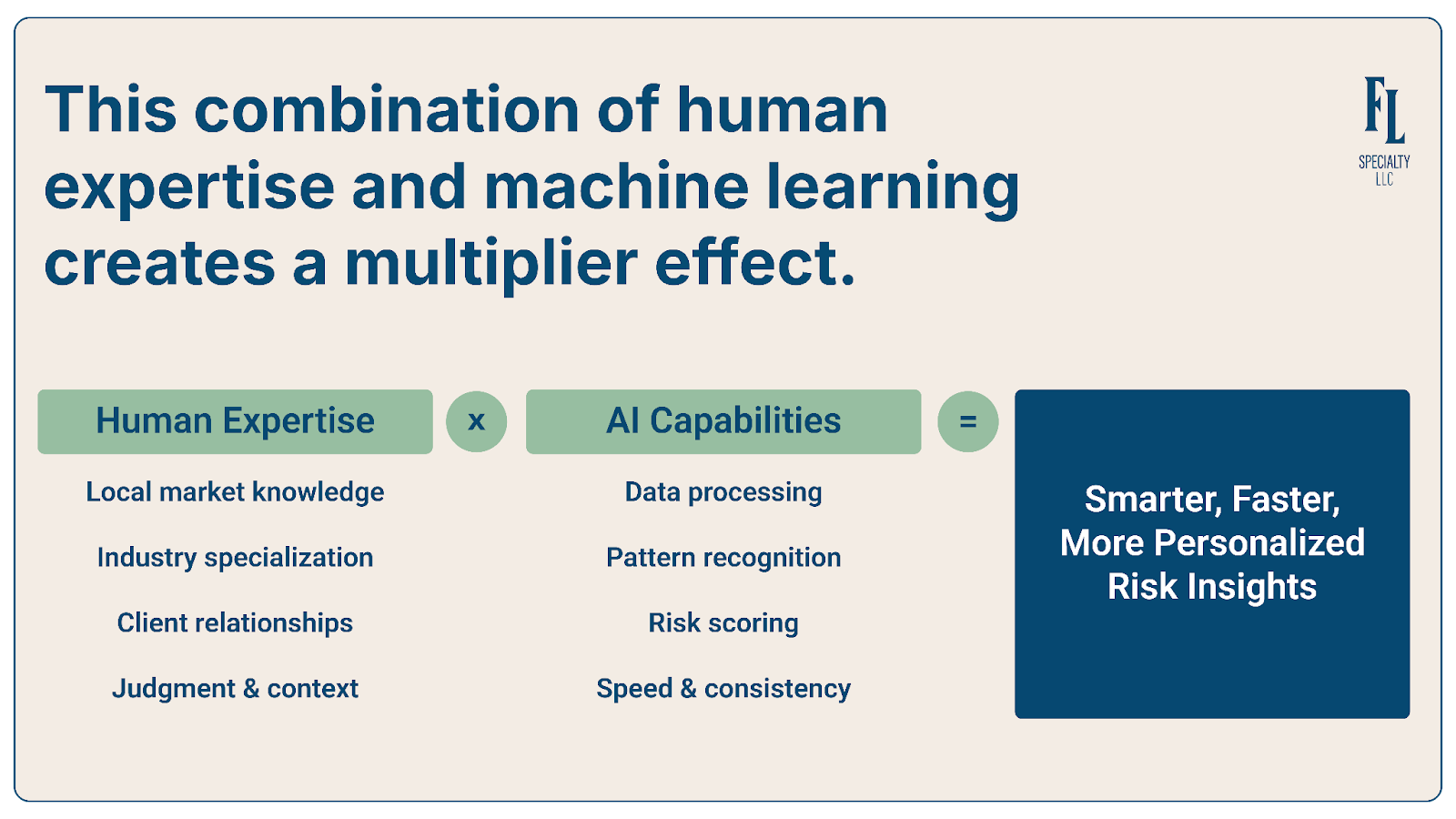

This combination of human expertise and machine learning creates a multiplier effect. The AI handles data processing, pattern recognition, and preliminary risk assessment at scale, while the broker applies contextual knowledge that no algorithm can replicate. A manufacturing client gets both the speed of automated analysis and the wisdom of someone who understands their business intimately.

The personalization extends beyond industry knowledge. Regional brokers know their clients' businesses personally—they've toured facilities, met management teams, and understand growth plans and risk tolerance. AI allows them to codify this knowledge into their systems, creating customized risk profiles and coverage recommendations that reflect genuine understanding rather than demographic generalizations.

Why Cost Barriers to AI for Insurance Brokers Have Disappeared

Perhaps the most dramatic change is economic accessibility. Cloud-based AI platforms for insurance brokers now offer sophisticated capabilities at price points accessible to mid-market brokerages, eliminating the need for massive IT investments. What once required a team of data scientists and custom-built infrastructure now exists as monthly subscription services that regional brokers can implement with minimal technical overhead.

The numbers tell a compelling story. Agencies using advanced policy management software report 18% higher revenue per employee compared to industry averages, while 90% of insurers are already adopting machine learning algorithms for claims and underwriting tasks. Regional brokers can access the same predictive analytics and automated tools that national firms spent millions developing, implementing these solutions faster with less organizational resistance.

This economic democratization extends across the entire technology stack. Natural language processing tools that extract data from policy documents, computer vision systems that assess property risks from satellite imagery, and predictive models that forecast claim likelihood—all are now available as affordable cloud services. A regional broker with a dozen employees can deploy tools that would have required enterprise-level budgets just five years ago.

Moreover, the implementation timeline has compressed dramatically. Where custom technology deployments once took 18-24 months and required extensive change management, modern AI platforms can be operational within weeks. Regional brokers avoid the implementation paralysis that plagues large organizations, where multiple stakeholders, legacy systems, and risk-averse cultures slow innovation to a crawl.

Speed and Efficiency Gains Enabled by AI for Insurance Brokers

AI excels in areas where regional brokers have struggled: speed of response, consistency of service, and comprehensive market analysis. In the past, a regional broker might take several days to analyze a complex risk, manually comparing coverage options across multiple carriers and constructing proposals. During this time, national firms with automated systems could deliver comprehensive proposals, creating a competitive disadvantage that lost deals.

Today, when a local manufacturer needs coverage, a regional broker equipped with AI can analyze risks and present options within hours rather than days, matching national firm responsiveness while providing superior local market insights. The AI instantly processes submission details, identifies relevant risk factors, matches against carrier appetites, and generates preliminary quotes—all while the broker focuses on strategic advisory rather than administrative processing.

The consistency improvements are equally significant. Human analysis, no matter how expert, varies based on workload, fatigue, and individual judgment. AI for insurance brokers provides consistent evaluation frameworks, ensuring that every risk receives thorough analysis regardless of when the submission arrives or who handles the initial review. This consistency builds trust with carriers, who come to recognize that submissions from AI-enabled regional brokers are thoroughly vetted and accurately presented.

Comprehensive market analysis represents another competitive leap. AI for insurance brokers can simultaneously evaluate coverage options across dozens of carriers, identifying niche markets and alternative solutions that human brokers might overlook. For regional brokers with deep carrier relationships, this capability allows them to leverage their entire network efficiently, ensuring clients receive truly optimized coverage rather than the limited options a manual search produces.

Scaling Without Losing Identity

Perhaps most importantly, AI enables regional brokers to scale their expertise without losing their identity. Rather than growing through acquisition like national firms—often diluting their culture and expertise in the process—regional brokers can use AI to amplify their specialized knowledge across larger client bases.

A transportation specialist who has built expertise serving trucking companies in a three-state region can now extend that expertise nationally. The AI handles the administrative scaling—processing applications, monitoring compliance across jurisdictions, tracking renewal dates—while the broker provides the same depth of expertise and personal attention to accounts regardless of location. They're not trying to become a national generalist; they're remaining a specialist who happens to serve clients across a broader geography.

This scaling preserves what clients value most: personalized service from experts who understand their industry. A broker specializing in craft breweries doesn't lose their identity by serving clients in multiple states—they deepen their value proposition by bringing concentrated expertise that national generalists cannot match, now supported by technology that allows them to manage larger client portfolios without compromising service quality.

The identity preservation extends to company culture and client relationships. Regional brokers don't need to adopt the bureaucratic processes and impersonal service models that characterize national firms. They maintain their responsiveness, flexibility, and relationship-focused approach while competing on analytical sophistication and operational efficiency.

The AI for Insurance Brokers Implementation Roadmap

For regional brokers ready to embrace this opportunity, the implementation path is clearer than ever. Start with high-impact, low-complexity applications—automated data entry, email triage, renewal processing—that deliver immediate efficiency gains and build organizational confidence. As teams become comfortable with AI augmentation, expand into more sophisticated applications like predictive risk modeling and automated coverage analysis.

Partner selection matters enormously, especially when adopting AI for insurance brokers rather than generic business tools. Prioritize vendors offering strong support and training, recognizing that successful AI implementation depends as much on human adoption as technical capability.

Invest in team development alongside technology deployment. Help brokers understand how AI extends their capabilities rather than replacing their expertise, positioning the technology as a tool that allows them to focus on high-value advisory work rather than administrative tasks. The most successful implementations create enthusiasm rather than anxiety, with teams quickly recognizing how AI for insurance brokers makes their jobs more interesting and impactful.

The Competitive Future

In this AI-enabled future, regional brokers don't need to become national to compete nationally—they just need to be smart about leveraging technology to extend their reach while preserving their competitive advantages. The playing field isn't just leveling; in many ways, it's tilting toward regional specialists who combine deep expertise with technological sophistication.

National brokers face their own challenges in this transition. Their legacy systems, complex organizations, and risk-averse cultures slow innovation. Their generalist model, once an advantage, becomes a liability when clients can access specialized expertise backed by sophisticated analytics from regional competitors. Their size, which provided economies of scale in the pre-AI era, now represents organizational inertia.

The winners in this transformed landscape will be brokers—regardless of size—who successfully integrate AI capabilities while maintaining the human judgment, relationship focus, and specialized expertise that clients truly value. For regional brokers, this represents the most significant competitive opportunity in a generation. The technology that once favored large organizations now empowers specialized competitors, creating a future where expertise and agility triumph over bureaucratic scale.

The question isn't whether regional brokers can compete with national players—it's whether national players can maintain their advantages against AI-enabled regional specialists who combine technology with the deep market knowledge and personalized service that clients increasingly demand.