Beyond SaaS: How AI-Enabled Custom Insurance Solutions Are Shaping the Future

The Promise That Became a Plateau

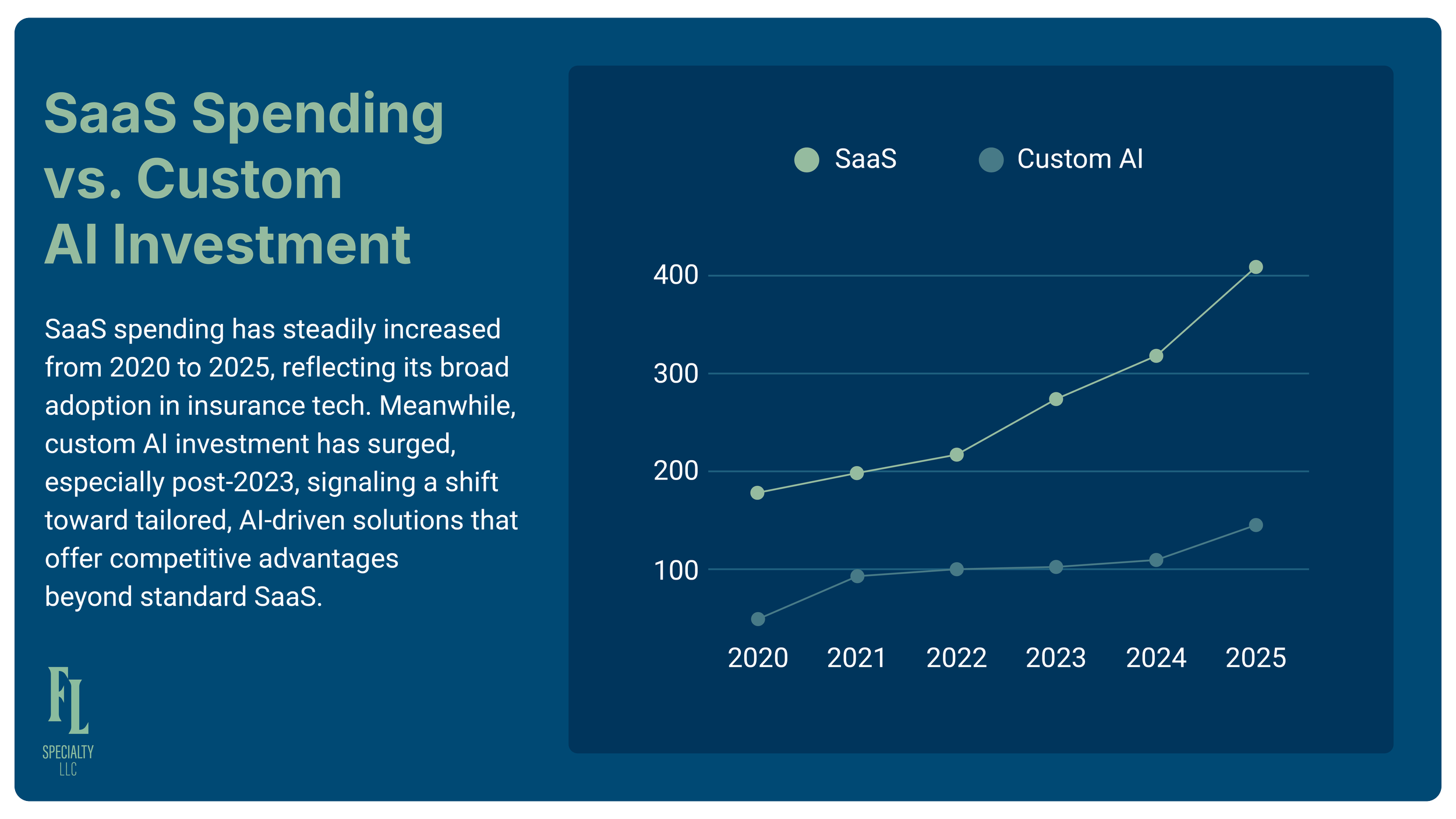

For the past decade, Software as a Service (SaaS) has been the technology success story of the insurance industry. Carriers, MGAs, and brokers flocked to cloud-based platforms promising faster implementations, reduced costs, and streamlined operations. And for many organizations struggling with legacy systems and manual processes, SaaS delivered exactly what was promised—to a point.

But as Klarna's recent high-profile decision to replace major SaaS platforms like Salesforce and Workday with AI-driven internal solutions demonstrates, a fundamental shift is underway. What was once the obvious choice for technology modernization is increasingly being questioned by forward-thinking leaders who recognize a critical limitation: SaaS solutions excel at getting you to the middle of the pack, but they can't get you to the front.

For insurance executives navigating an increasingly competitive landscape, this distinction isn't just technical—it's strategic. The companies that will dominate the next decade of commercial P&C insurance won't be those with the most efficient back-office operations. They'll be those that leverage AI-enabled custom insurance software solutions to create genuine competitive advantages in their core business processes.

The SaaS Success Story (And Its Inherent Limits)

Let's acknowledge what SaaS has accomplished in insurance. Platforms for underwriting, claims processing, and customer management have helped countless organizations modernize operations that were previously bogged down by paper-based workflows and disparate systems. The benefits are undeniable: reduced implementation timelines, predictable subscription costs, and immediate access to capabilities that would have taken years to develop internally.

The standardization that SaaS platforms provide has been particularly valuable for insurance companies operating with significant technical debt. Manual processes, workarounds, and integration challenges that plagued legacy operations suddenly became manageable through unified platforms designed specifically for insurance workflows.

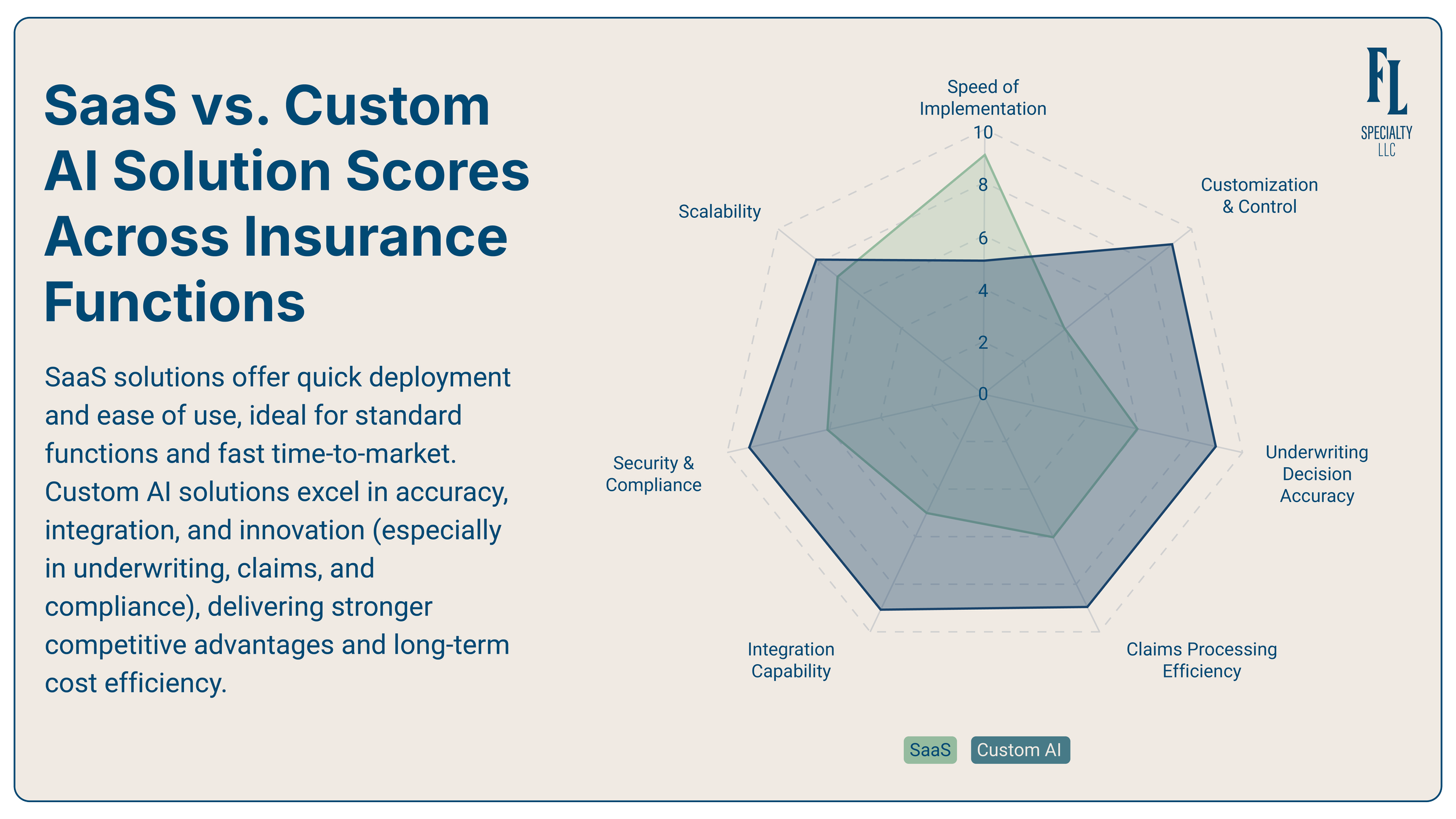

But standardization cuts both ways. The same consistency that makes SaaS platforms attractive to individual clients creates a fundamental competitive problem: when multiple companies in the same market use identical systems, they inevitably converge toward similar operational capabilities. This convergence might be acceptable—even beneficial—for commodity functions like accounting or network security, where differentiation adds little value.

However, when SaaS platforms handle core business processes like underwriting risk assessment, claims evaluation, or customer relationship management, standardization becomes a strategic liability. Consider the implications: if your underwriting platform uses the same algorithms, data sources, and decision trees as your competitors', how do you develop superior risk selection capabilities? If your claims system follows identical workflows to everyone else in your market, where's your operational advantage?

Why SaaS Falls Short for Insurance's Core Operations

The Technical Debt Reality

Most P&C insurance companies face a similar challenge: decades of accumulated technical debt that manifests as manual processes, system workarounds, and integration complexities that make everyday operations more difficult than they should be. SaaS platforms promise to solve these problems through pre-built functionality and standardized workflows.

The reality is more nuanced. While SaaS can indeed streamline many processes, it often does so by forcing organizations to adapt their operations to fit the platform's capabilities rather than optimizing the platform to support unique competitive advantages. This constraint becomes particularly problematic when dealing with complex, multi-step processes that span different lines of business or require specialized expertise.

The Customization Myth

SaaS providers face a fundamental tension: they must serve multiple clients across diverse market segments while maintaining the economies of scale that make their business model viable. This dynamic creates powerful incentives for providers to claim they can address all needs for all clients, often leading prospects to believe extensive customization is possible.

The practical reality is different. True customization—the kind that creates genuine competitive differentiation—often conflicts with the standardization requirements that allow SaaS platforms to operate efficiently. A workers' compensation underwriting system, for example, may promise adaptability to other lines of business, but the specialized knowledge required for excess liability underwriting simply can't be replicated through configuration options.

This isn't necessarily the SaaS provider's fault. Many platforms are developed by teams with strong technical capabilities but limited domain expertise in the specific nuances of insurance operations. While they may understand broadly applicable disciplines like accounting or information security, they lack the deep knowledge of product-specific underwriting guidelines, form structures across various lines of business, or the subtle risk assessment factors that distinguish superior underwriters from average ones.

The Innovation Dilution Problem

Even when SaaS platforms do accommodate specific client needs through customization, a more insidious problem emerges: innovation dilution. For SaaS providers to maintain profitability, they must leverage commonality across their code base and feature sets. This means that genuinely valuable innovations developed for one client will eventually—and reasonably—be incorporated into the platform's general offering.

The result is a cycle where your competitive advantages either get shared with competitors or become constrained by the platform's existing architecture. Unique functionality gets crammed into existing structures like a square peg in a round hole, creating operational friction and limiting the potential impact of innovation.

The AI Revolution: Changing the Economic Equation

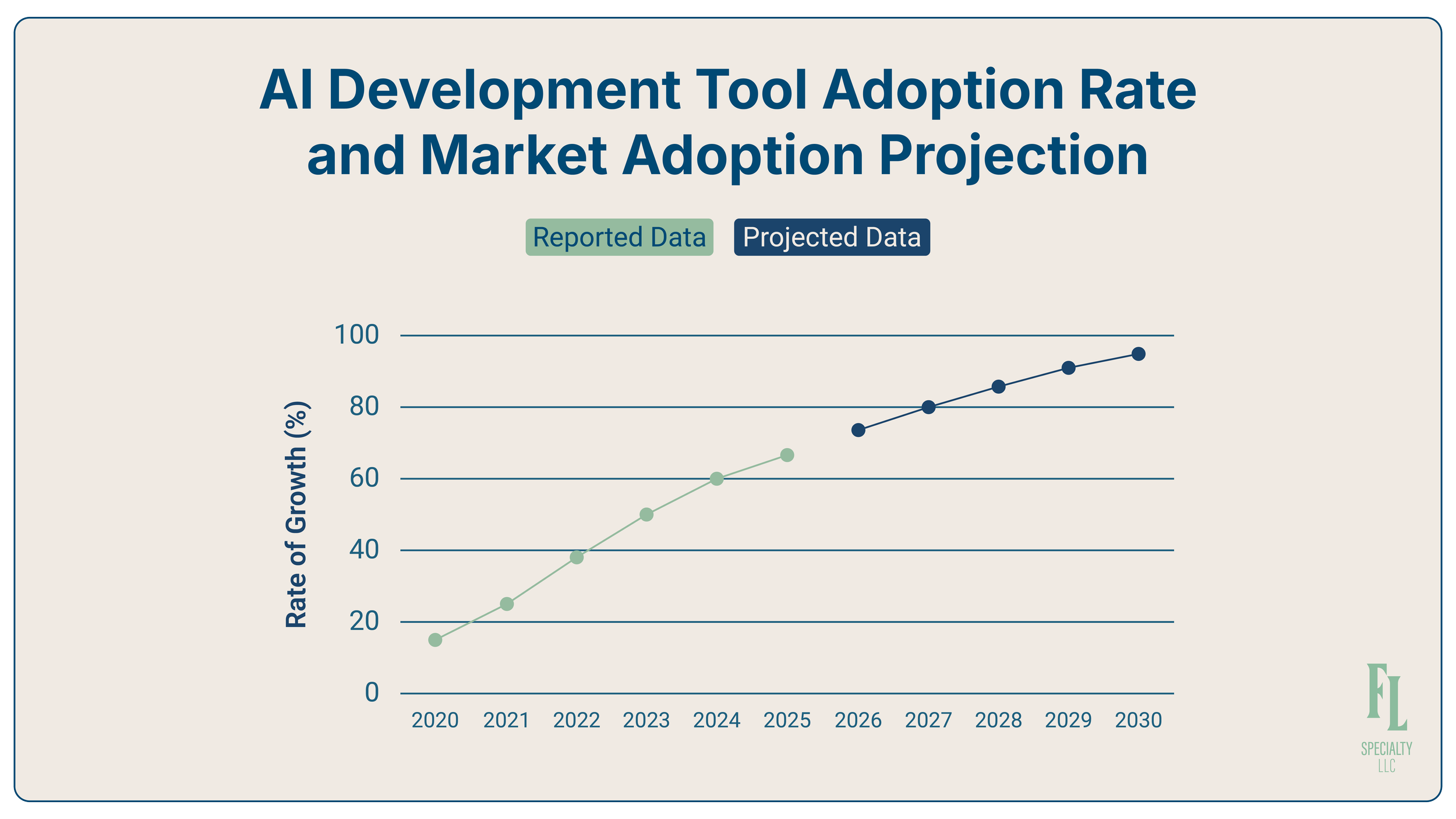

The emergence of artificial intelligence as a practical development tool has fundamentally altered the economics of custom software development. What Klarna discovered—and what Fall Line Specialty has experienced firsthand—is that building custom insurance solutions in the post-AI era is dramatically different from traditional development approaches.

The New Economics of Custom Development

AI-powered development tools have reduced both the cost and complexity of creating custom insurance solutions. Development cycles that previously required months or years can now be completed in weeks. Maintenance overhead that made custom solutions prohibitively expensive for many organizations has become manageable through AI-assisted code management and automated testing.This economic shift creates new strategic options for insurance leaders.

Strategic vs. Commodity Functions

The key insight for insurance executives is recognizing which functions should remain commoditized through SaaS platforms and which demand custom insurance solutions for competitive advantage. Back-office functions like payroll processing, basic accounting, or standard compliance reporting don't typically create competitive differentiation—these are ideal candidates for continued SaaS utilization.

Core business processes, however, present different considerations. Underwriting algorithms that identify risks your competitors miss, claims processing workflows that improve customer satisfaction while reducing costs, or customer engagement platforms that increase retention rates—these capabilities can create sustainable competitive advantages when properly implemented.

Real-World Applications: AI-Enabled Custom Insurance Solutions in Action

The shift from SaaS to AI-enabled custom solutions is already creating tangible advantages across insurance operations.

Underwriting Operations

Consider submission triage and risk assessment—processes that many carriers have standardized through SaaS platforms. While these systems provide consistency, they also ensure that your risk evaluation capabilities mirror those of your competitors. Custom AI solutions can analyze submission patterns specific to your portfolio, identify opportunities that others miss, and continuously learn from your unique underwriting decisions.

For example, an AI-powered submission triage system tailored to your specific appetite and historical performance can prioritize opportunities that align with your strategic objectives rather than applying generic industry standards. This specificity can dramatically improve both underwriting efficiency and risk selection quality.

Product Development

Perhaps nowhere is the limitation of SaaS platforms more apparent than in product development. Standard systems are designed around existing, well-established coverage types and can struggle to accommodate innovative products or rapid market response capabilities.

AI-enabled custom development allows for rapid prototyping of new coverage types, dynamic form generation for emerging risks, and pricing model development that can respond to market opportunities in real-time rather than waiting for platform updates or vendor roadmaps.

The Strategic Framework: When to Build vs. Buy vs. Partner

Insurance leaders need a clear framework for evaluating technology decisions in this new environment. The goal isn't to replace every SaaS platform with custom development—it's to strategically deploy custom insurance solutions where they create the greatest competitive value.

The Three-Tier Approach

Tier 1: Commodity Functions Continue leveraging SaaS platforms for functions that don't create competitive differentiation. Payroll, basic accounting, standard compliance reporting, and similar back-office operations should remain with established SaaS providers where standardization adds value and customization provides minimal benefit.

Tier 2: Competitive Differentiators Deploy AI-enabled custom solutions for processes that directly impact competitive positioning. Underwriting decision support, claims optimization, customer engagement platforms, and risk assessment tools should be evaluated for custom development when they can create measurable competitive advantages.

Tier 3: Core Strategic Advantages Invest in proprietary development for capabilities that define your market position. These might include specialized underwriting expertise for niche markets, innovative product development capabilities, or unique data analytics that inform strategic decisions.

Implementation Strategies

The transition from SaaS dependence to strategic custom development doesn't require wholesale replacement of existing systems. A dual-track approach allows organizations to maintain current operations while building future capabilities in parallel.

This strategy minimizes implementation risk while enabling gradual migration to custom insurance solutions as they prove their value. It also provides opportunities to validate AI-enabled development approaches before committing to comprehensive transformation.

Overcoming Implementation Barriers

The Resource Challenge

The most common objection to custom development is the perceived resource requirement. Insurance companies often lack the AI expertise necessary to build and maintain custom solutions internally. This challenge has created opportunities for new service models that combine insurance domain expertise with AI development capabilities.

Rather than building internal AI development teams, many organizations are exploring managed services partnerships that provide access to specialized expertise without the overhead of permanent staffing. This approach allows insurance companies to focus on their core competencies while leveraging cutting-edge development capabilities through strategic partnerships.

The Risk Management Perspective

Insurance executives are naturally risk-averse, and custom development represents a different risk profile than established SaaS platforms. However, the competitive risk of standardization may ultimately exceed the technology risk of custom development, particularly as AI tools continue to reduce development complexity and maintenance overhead.

The key is transferring operational risk to partners with specialized expertise rather than assuming it internally. This approach provides the benefits of custom insurance solutions while maintaining predictable cost structures and performance guarantees.

The Competitive Advantage Opportunity

Market Timing

The insurance industry is experiencing simultaneous pressures from consolidation, regulatory change, and technological disruption. Companies that establish AI-enabled operational advantages during this transition period will be positioned to capture disproportionate market share as the industry stabilizes around new competitive dynamics.

Early movers in AI-enabled custom development will also benefit from learning curve advantages and market positioning that become increasingly difficult to replicate as the approach becomes more widespread.

Long-term Strategic Benefits

The benefits of AI-enabled custom insurance solutions extend beyond immediate operational improvements. Organizations that develop internal AI capabilities create platforms for continuous innovation that can adapt to changing market conditions, regulatory requirements, and competitive pressures.

These capabilities compound over time, creating sustainable competitive advantages that become increasingly difficult for competitors to replicate through standard SaaS implementations.

Your Strategic Decision Point

The shift from generic SaaS platforms to AI-enabled custom solutions represents more than a technology trend—it's a fundamental change in how competitive advantages are created and sustained in the insurance industry.

Companies following Klarna's lead aren't simply replacing one set of tools with another. They're recognizing that in an industry where operational excellence increasingly determines market success, standardized solutions inevitably lead to standardized outcomes.

The question for insurance leaders isn't whether AI will transform software development—it already has. The question is whether your organization will leverage this transformation to create competitive advantages or continue accepting the operational parity that SaaS platforms provide.

For forward-thinking executives, the window for establishing AI-enabled advantages remains open, but it won't remain so indefinitely. The companies that move decisively to build custom capabilities aligned with their strategic objectives will define the competitive landscape for the next decade of commercial P&C insurance.

As the industry continues evolving, one thing has become clear: operational excellence will increasingly separate market leaders from followers. The tools to achieve that excellence are available today—the strategic decision is how to deploy them most effectively for your organization's unique competitive position.

Ready to explore how AI-enabled custom insurance solutions can transform your operations? Fall Line Specialty combines deep insurance expertise with cutting-edge AI capabilities to help P&C leaders build competitive advantages, not just operational efficiency. Our Results as a Service model allows you to access enterprise-level AI capabilities without the complexity of internal development. Contact us to discuss your strategic technology roadmap and discover how we can help you move beyond SaaS limitations to true competitive differentiation.

References

[1] Grand View Research. (2024). Custom software development market size, share & trends analysis report, 2023–2030. Grand View Research. Retrieved July 10, 2025, from https://www.grandviewresearch.com/industry-analysis/custom-software-development-market

[2] Precedence Research. (2024). SaaS market size & forecast 2025–2034. Precedence Research. Retrieved July 10, 2025, from https://www.precedenceresearch.com/saas-market

[3] Codence. (2025). Why AI is driving businesses from SaaS to custom software. Codence. Retrieved July 10, 2025, from https://www.codence.com/ai-driving-businesses

[4] LeewayHertz. (2025). AI for claims processing: Efficiency gains in insurance. LeewayHertz. Retrieved July 10, 2025, from https://www.leewayhertz.com/ai-claims-processing

[5] LinkedIn. (2025). AI-powered product development in SaaS: Trends and statistics. LinkedIn Insights. Retrieved July 10, 2025, from https://www.linkedin.com/insights/ai-product-development-saas

[6] Canvas Business Model. (2025). Assurant: Competitive landscape and technology investments. Canvas Business Model. Retrieved July 10, 2025, from https://www.canvasbusinessmodel.com/assurant-competitive-analysis

[7] Applify. (2025). AI in insurance underwriting: Accuracy and automation. Applify. Retrieved July 10, 2025, from https://www.applify.com/ai-insurance-underwriting

[8] Cflow Apps. (2024). How no-code workflows reduce SaaS vendor onboarding time. Cflow Apps. Retrieved July 10, 2025, from https://www.cflowapps.com/no-code-workflows-saas

[9] HCL Technologies. (2025). Speed, accuracy, and AI in underwriting. HCL Technologies. Retrieved July 10, 2025, from https://www.hcltech.com/ai-underwriting

[10] Flatlogic. (2025). Custom vs. generic software: How AI changes the economics of software development. Flatlogic. Retrieved July 10, 2025, from https://flatlogic.com/blog/custom-vs-generic-ai-software