How AI-Powered Portfolio Analytics Improve Insurance Profitability for Carriers

Every insurance carrier faces the same challenge. You know certain parts of your portfolio are underperforming, but you can only make broad pricing changes across entire states or product lines. You lack the detailed view needed for targeted action.

Your retention rate sits at 80% when you need 85%. Some agency partnerships are highly profitable while others drain resources, but you can't easily tell which is which. Your underwriters spend nearly half their time on paperwork instead of making risk decisions.

Meanwhile, you're sitting on thousands of documents (policies, loss reports, claims files) that contain the answers you need. But getting useful insights from all this data seems impossible without spending millions on new technology.

This is today's portfolio management challenge. The data exists. The need is clear. But connecting them feels out of reach.

Until now.

The Real Cost of Limited Visibility on Insurance Profitability

Research from Willis Towers Watson reveals what’s at stake for insurance profitability: companies with strong portfolio management achieve combined ratios 8 points better than those without—the difference between a 98% COR and a 106% COR.[1] For a mid-sized carrier, that gap means tens of millions in lost profit.

Yet according to Quantee's analysis, surprisingly few carriers have the proper technology, data integration, and analytical capabilities to manage portfolios effectively.[2] The old approach of looking backward at last year's results and making broad adjustments, no longer works in today's market.

Consider what leadership typically wants: less dependence on a few big segments, better retention through smarter pricing, and tools for regional managers to make good decisions. But achieving these goals seems to require capabilities that feel impossible: detailed segmentation, real-time agency analytics, and targeted pricing that doesn't mean repricing everything. The missing piece? The ability to quickly analyze the thousands of documents that already contain these insights is important.

Document Intelligence: A Hidden Lever for Insurance Profitability

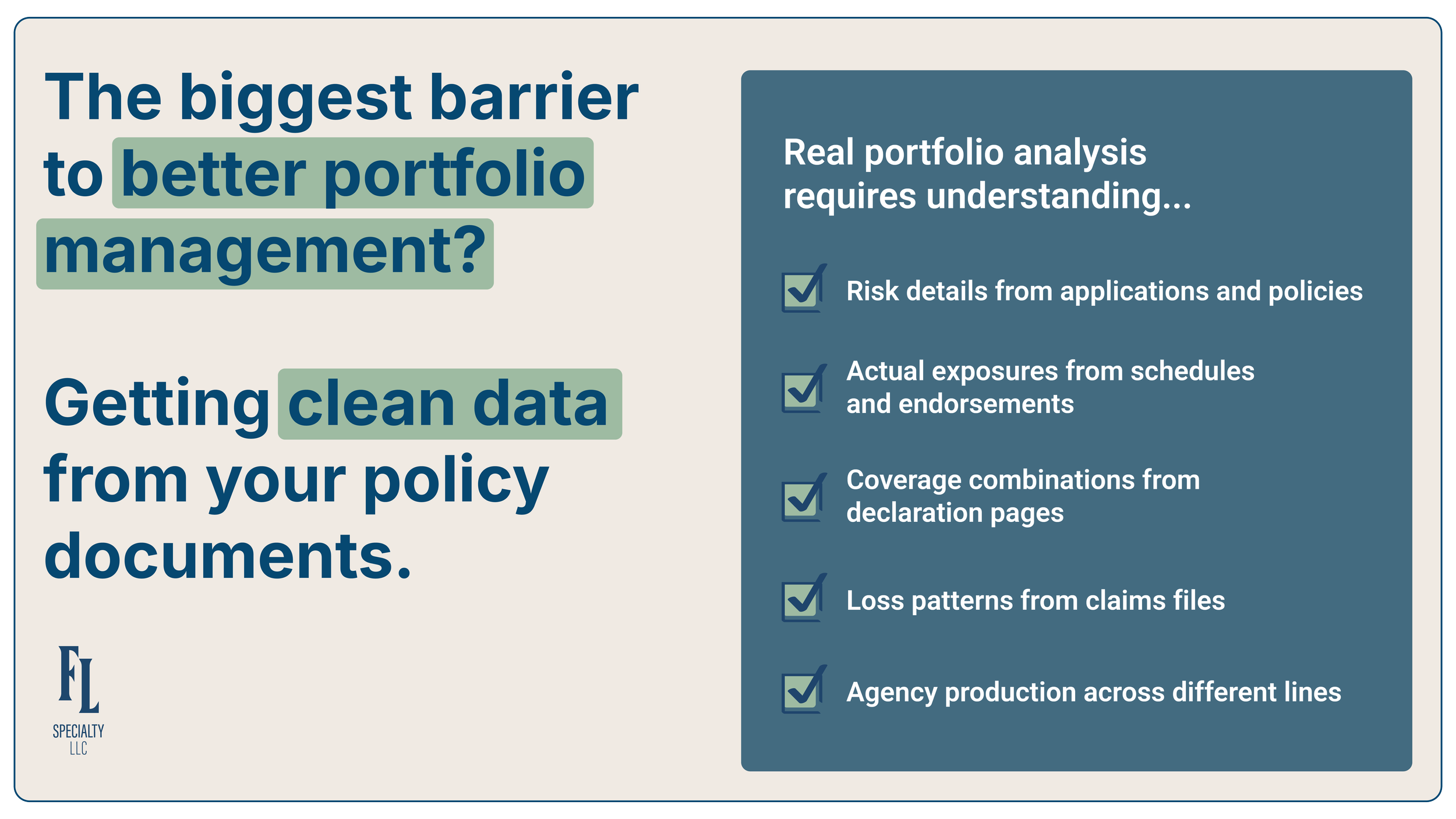

Here's what many carriers miss: the biggest barrier to better portfolio management and improved insurance profitability isn’t complex math or fancy algorithms. It's the basic task of getting clean data from your policy documents.

Real portfolio analysis requires understanding:

Risk details from applications and policies

Actual exposures from schedules and endorsements

Coverage combinations from declaration pages

Loss patterns from claims files

Agency production across different lines

All this information already exists in your systems though scattered across PDFs, emails, and databases. Traditional methods require teams of analysts manually reviewing documents and building spreadsheets. By the time they finish, the market has changed.

AI document analysis changes everything. Modern systems can process thousands of documents in hours, not weeks, extracting data with accuracy that matches or exceeds human review.[3] They understand insurance context, reading policies like an experienced underwriter would, but at computer speed.

This isn't simple text extraction. It's intelligent analysis that knows the difference between a blanket limit and stated values, understands ACORD forms, and recognizes when specific class codes signal underpricing risk.

Building Better Portfolio Management

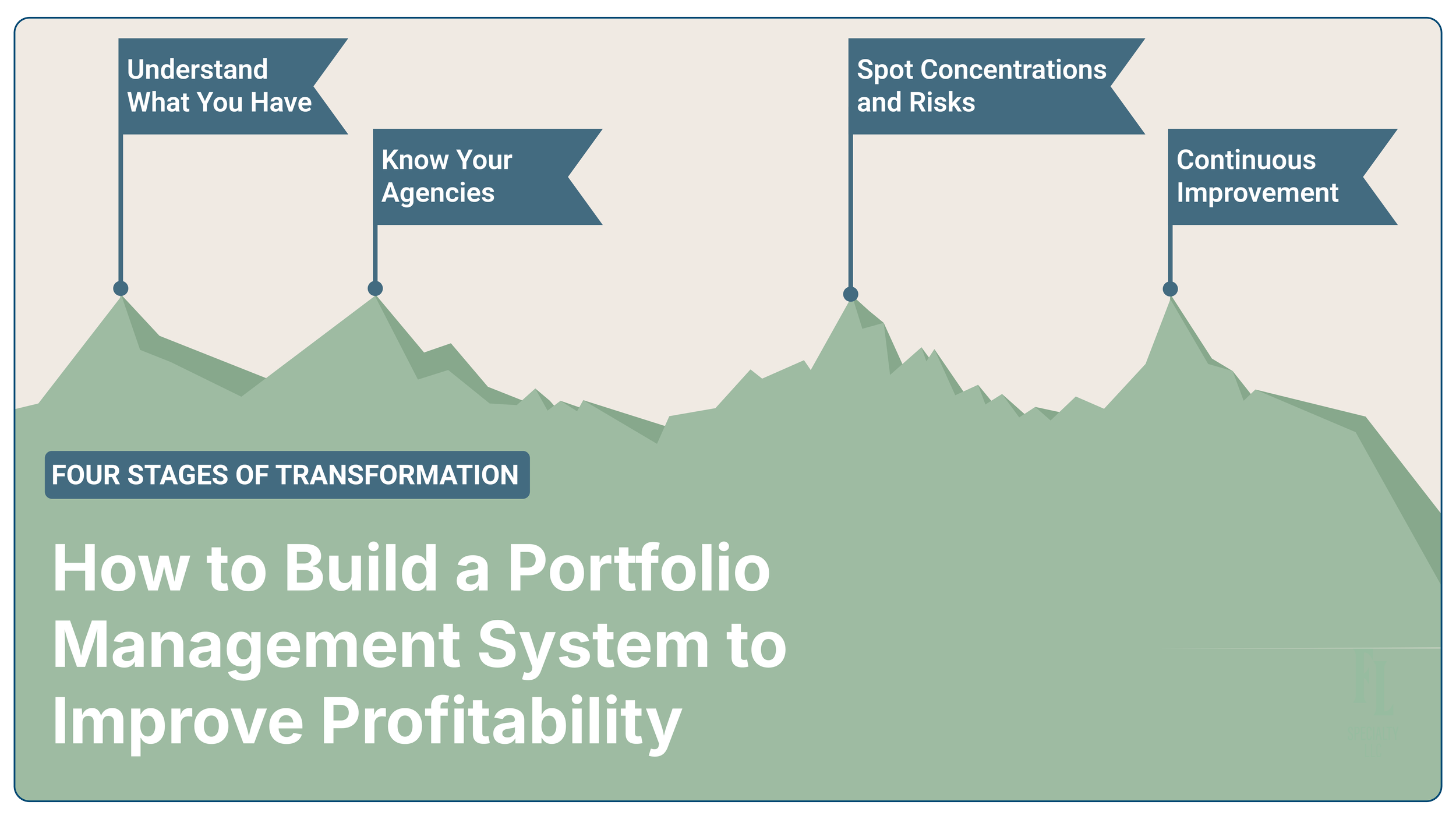

With AI document analysis as your foundation, you can build the portfolio management system needed to improve insurance profitability with precision. The transformation happens in stages, each delivering immediate value.

Stage 1: Understand What You Have

Start by establishing the truth about your portfolio. AI analyzes every policy, endorsement, and schedule to create a complete picture. This reveals problems hiding in plain sight:

Policies with wrong class codes

Mismatched territories

Exposure schedules that don't align with ratings

Conflicting endorsements

One regional carrier discovered that 23% of their commercial auto policies had incorrect garaging locations, a direct result of manual data entry errors. Fixing these errors improved pricing accuracy and revealed systematic problems in how they processed applications.

This analysis also enables smarter segmentation. Instead of viewing your book by state or product line, you can segment by actual risk characteristics and loss patterns. This makes the targeted pricing changes leadership wants actually possible.

Stage 2: Know Your Agencies

Research from WTW shows that effective portfolio management requires understanding not just the risks you write, but who brings them to you.[4] Most carriers struggle with basic agency questions:

Which agencies bring profitable business?

Which have high losses despite strong sales?

Which relationships lose money after all costs?

AI connects submission documents, policies, and losses at the agency level. It spots patterns humans miss:

Agency A submits incomplete applications requiring extensive follow-up

Agency B writes great accounts but only in high-risk areas

Agency C's loss ratios run 15 points worse than similar agencies

Left unaddressed, these patterns quietly erode insurance profitability, even when top-line growth looks strong. According to Agilytic's broker segmentation research, carriers that properly analyze their distribution networks can identify roughly 200 high-potential or underdeveloped agency relationships that need immediate attention.[5] This visibility helps you allocate resources based on data, not just relationships.

Stage 3: Spot Concentrations and Risks

Insurance portfolio management research from CII emphasizes that portfolios are groupings of risks with similar characteristics that react similarly to loss events.[6] Yet many carriers can't precisely answer concentration questions:

How much exposure do you have to catastrophic events?

Which class codes drive losses?

Where do similar risks create hidden accumulations?

AI reads every property schedule, equipment list, and vehicle roster to understand actual exposure accumulation. It recognizes when multiple policies in the same area or industry create concentration risks that summary reports miss.

This enables targeted action:

Adjust pricing for problem segments without broad increases

Make informed decisions about which concentrations to reduce

Structure reinsurance based on actual exposure

Stage 4: Continuous Improvement

WTW's research shows that active portfolio management requires three essentials: identifying meaningful risk groupings, making decisions based on quality data, and responding quickly to issues.[4]

AI-powered portfolio management delivers all three. The most successful carriers use these insights for ongoing refinement. Instead of annual planning cycles, they make quarterly adjustments:

Set clear targets for portfolio segments

Monitor results with minimal delay

Spot issues quickly through automated alerts

Analyze causes using detailed data

Implement fixes within weeks

One specialty carrier compressed their annual planning into quarterly improvements. They saw measurable combined ratio improvement within six months. More importantly, they shifted from reactive planning to proactive management.

Implementation: Easier Than Expected

Here's good news: AI portfolio management doesn't require replacing your existing systems. Modern platforms work with your current setup:

Connect to policy systems through standard interfaces

Process documents in secure cloud environments

Feed insights into your existing reports

The technology complexity is handled by the platform. Your team focuses on using the insights.

According to Quantee's analysis, insurers can reduce combined ratios by up to 6 percentage points simply by improving their fragmented pricing process and reducing time-to-market for pricing changes.[2] AI document analysis makes this possible and delivers in days what previously took months.

Finding Hidden Opportunities

Leading carriers use these tools not just to fix problems but to find opportunities. When you can analyze your entire portfolio in detail, you discover profitable niches your competitors miss, agencies with growth potential, and emerging trends before they hit loss ratios.

Research from the Insurance Journal emphasizes that one of the big values of segmentation is identifying your most profitable customers, which aren't always those generating the most revenue.[7] Some smaller-revenue segments have low service costs and excellent loss experience. AI analysis reveals these hidden gems.

This shifts portfolio management from defense to offense: actively steering toward the best risk-return combinations.

Why This Matters Now

The insurance industry is changing rapidly. Carriers that master portfolio management will succeed. Those that stick with annual planning and broad segments will struggle.

According to Quantifi's analysis, shifting demographics, heightened competition, and regulatory changes make strategic portfolio management crucial.[8] Your ability to make smart decisions about which risks to write and which agencies to prioritize determines whether you outperform the market.

Carriers that move first gain advantages that compound over time. They make better decisions faster. They find opportunities others miss. They optimize insurance profitability while competitors wonder why certain segments fail.

Getting Started: Your Roadmap

Begin by assessing your current state. Can you segment beyond state and product line? Do you know which agencies are truly profitable? Can you identify concentration risks? Can you make targeted pricing changes?

If you find gaps, start with document intelligence. Pick a defined scope (perhaps one product line or region) and use AI to establish your baseline. These initial insights will guide the next steps and build organizational confidence.

The investment is measured in months, not years. Returns begin immediately as you uncover issues and opportunities in your existing data.

The Path Forward

Portfolio management isn't just about managing what you have. It's about building the portfolio you want while managing the risks that come with it.

AI document analysis removes the data bottleneck that has limited portfolio management for decades. It turns static policy documents into strategic assets. It makes sophisticated analytics accessible to regional and specialty carriers, not just industry giants.

Carriers that embrace these capabilities won't just improve their combined ratios by a few points. They'll transform how they compete, making smarter decisions faster, identifying opportunities sooner, and executing with precision their competitors can't match.

The question isn't whether AI will transform insurance portfolio management. It's whether you'll lead that transformation or play catch-up as the market moves forward.

Your data holds the answers. The technology exists to unlock them. The only decision left is when to start.

Fall Line Specialty helps regional and specialty insurance carriers transform portfolio management through AI document intelligence and collaborative analytics. Our approach combines automated data extraction with hands-on insurance expertise to deliver actionable insights quickly, without requiring major infrastructure changes. Because sophisticated portfolio management shouldn't require enterprise-scale resources.

Continued Reading

Ready to turn portfolio insight into measurable insurance profitability?

Continue exploring how carriers uncover hidden risk, sharpen portfolio fundamentals, and make smarter decisions with clearer data.

References

[1] Willis Towers Watson. "Insurance portfolio management." Accessed December 2025.

https://www.wtwco.com/en-gb/solutions/services/insurance-portfolio-management

[2] Quantee. "Portfolio management in insurance pricing." Accessed December 2025.

https://www.quantee.ai/resources/portfolio-management-in-insurance-pricing

[3] Fintech Global. "How to master insurance portfolio management." July 22, 2024.

https://fintech.global/2024/07/22/how-to-master-insurance-portfolio-management/

[4] Willis Towers Watson. "Active portfolio management." Accessed December 2025.

https://www.wtwco.com/en-gb/solutions/services/insurance-portfolio-management

[5] Agilytic. "Identifying commercial potential with segmentation in insurance." Accessed December 2025.

https://www.agilytic.com/results/broker-segmentation-boost-performance-insurance

[6] Chartered Insurance Institute. "Portfolio management in insurance." Accessed December 2025.

https://www.ciigroup.org/learning/learning-content-hub/articles/portfolio-management-in-insurance/

[7] Insurance Journal. "The Role of Data Analytics in Marketing for Insurance." July 1, 2024.

https://www.insurancejournal.com/magazines/mag-features/2024/07/01/781333.htm