Transforming Loss Run Reports & Management with AI: A Strategic Advantage for Agencies

Insurance agents and brokers remain the backbone of commercial P&C distribution—but too often, administrative burden limits their strategic impact. One of the most frustrating and time-consuming processes? Managing loss run reports.

This case study explores how AI can streamline the entire loss run process—not just reducing friction, but turning a compliance chore into a value-generating tool. The result? Stronger client relationships, faster quoting cycles, and a clearer path to competitive differentiation.

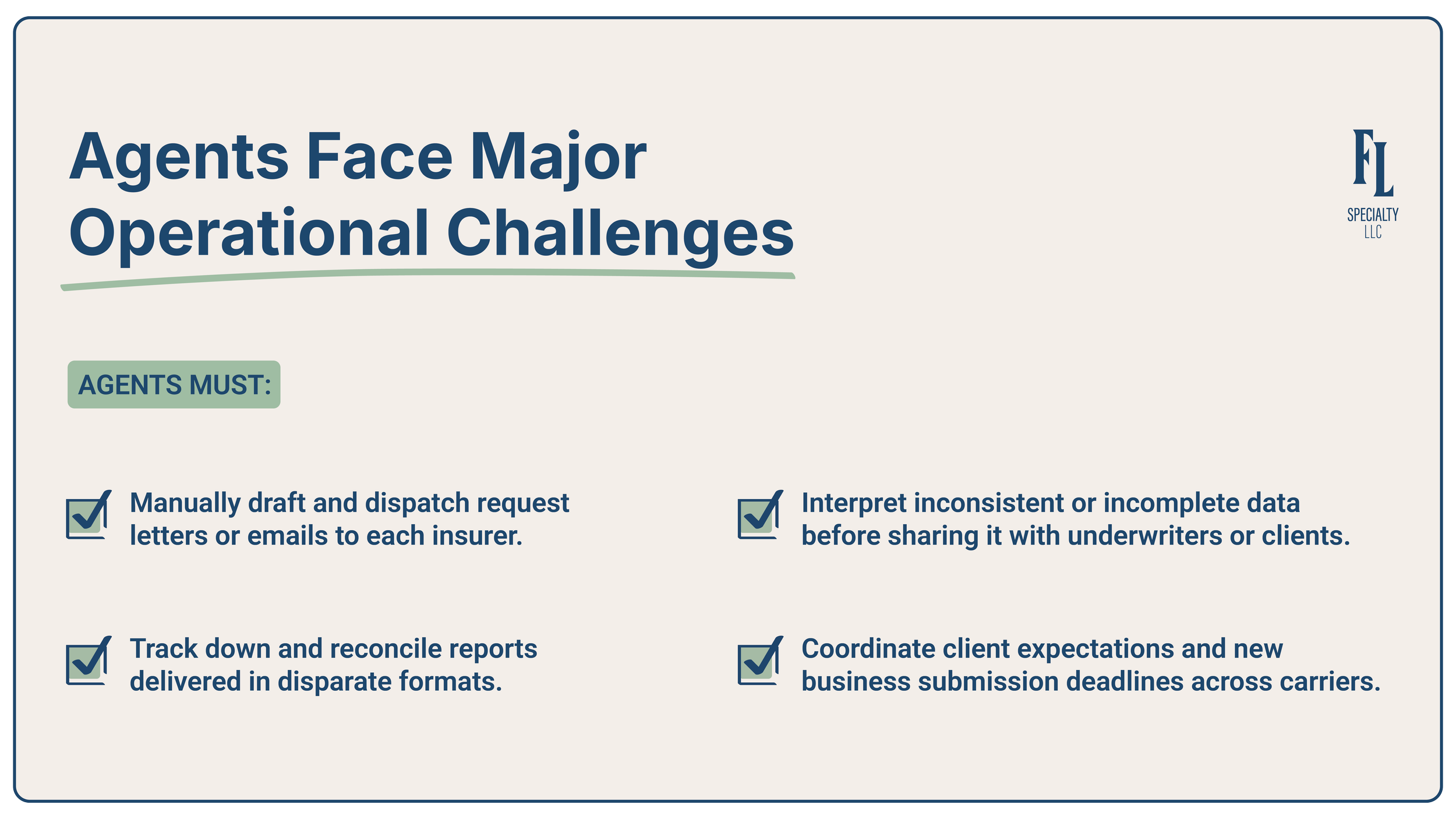

The Operational Challenge

Loss run management is one of the most notoriously inefficient workflows in the industry. Agents must send manual requests to multiple carriers—each with their own systems, timelines, and reporting formats. While most states mandate carriers respond within 10 days, real-world delays, data inconsistencies, and incomplete reports are the norm.

When multiplied across dozens of clients and renewal cycles, the administrative drag is significant, pulling brokers away from high-value activities like advising, marketing, and business development.

Why It Matters

These inefficiencies come at a cost—both financial and reputational.

Studies show:

Agents spend 40–60% of their time on administrative tasks.

Producers spend 30–40% of their time rekeying or manually analyzing data.

Loss run delays often hold up quotes, risking missed opportunities.

Operational costs climb when staff must revisit submissions due to incomplete or inaccurate data. And even worse, poor client experiences due to delays and confusion can erode trust and open the door to more responsive competitors.

For agencies facing margin pressure, loss run inefficiency is a silent profit killer. But it’s also an opportunity for those ready to lead with technology.

The AI-Enabled Solution

AI transforms the loss run process from a manual bottleneck into a seamless, intelligent workflow. Here’s how:

1. Automated Data Collection

AI bots issue and track loss run requests across carriers, eliminating repetitive follow-ups and freeing agents to focus on client strategy.

2. Format Standardization

Machine learning models extract, clean, and standardize data from disparate loss run formats—turning messy PDFs into structured insights.

3. Proactive Risk Insights

AI doesn’t just collect data—it interprets it. Systems surface trends, flag red flags, and deliver actionable insights that fuel better underwriting and smarter client conversations.

4. System Integration

Loss run platforms plug directly into agency management systems, carrier portals, and communication tools—eliminating data silos and double-entry.

5. Client Enablement

Rather than chasing paperwork, agents can now deliver real-time insights on client risk performance, renewal prep, and strategic coverage design.

What once took days or weeks is reduced to hours or less—with far less manual effort and far greater impact.

The Fall Line Approach

At Fall Line, we guide agencies through a structured AI journey tailored to their growth goals and operational maturity. Our framework delivers quick wins early and compounds strategic value over time:

Phase 1: Foundation and Quick Wins – We identify low-friction, high-impact use cases—often focused on automation. From reducing response time to standardizing loss run reports, we help agencies unlock meaningful improvements in just weeks.

Phase 2: Enhanced Capabilities – Once workflows are stabilized, we build on that foundation with innovative solutions that streamline quoting, improve the client experience, and enable faster decision-making.

Phase 3: Competitive Advantage – With friction removed and insights flowing, we help agencies use AI for differentiation—advisory tools, predictive insights, and performance analytics that truly set them apart.

Conclusion

Loss run reports and management may feel like a back-office burden. But with AI, they become a front-line differentiator.

By reimagining the loss run reports and workflow, agencies can unlock operational efficiency, reduce delays, and turn raw claims data into actionable intelligence.

Fall Line’s proven implementation framework helps brokers go from reactive administration to strategic enablement—delivering better outcomes for clients, underwriters, and the agency itself.

The time to modernize loss run management isn’t someday—it’s now.

Next Up…

Ready to move from high-level AI trends to real execution? Explore where risk, capital, and opportunity intersect next.