The Hidden Risk in Insurance Portfolio Management: Why Policy Clarity Is Crucial in E&S

How tech and smarter insurance portfolio management is unlocking deeper visibility—and profitability—in today’s complex E&S landscape

The Problem Hiding in Plain Sight

You’re managing a book of business worth millions. Your dashboards look clean—loss ratios, portfolio composition, and profitability metrics all reporting as expected. Premiums are categorized neatly under "Commercial Auto," "General Liability," "Cyber," and more.

But here’s the hard truth: what your system shows and what’s actually written into those policies are often two very different things.

This gap isn’t just a data hygiene issue. It’s a significant blind spot in insurance portfolio management—one that’s especially risky in the E&S space, where bespoke policy language, non-standard terms, and creative risk structures are the norm. And when portfolio clarity is missing, so is your ability to assess risk, identify opportunities, and scale profitably.

The biggest risk in your portfolio might not be a coverage gap, it might be a clarity gap. Let’s get into it.

When Standard Systems Meet Non-Standard Business

Your system might say one thing, but your policies might say another. And in specialty insurance, that mismatch can cost you.

In the world of excess and surplus (E&S) lines, uniformity doesn’t exist. That’s the value AND the risk. Each policy is crafted to meet complex, often unconventional needs. When a manufacturer needs coverage for a novel AI process, or a tech company seeks protection for emerging liabilities, underwriters tailor custom solutions through manuscript forms, unique endorsements, and one-off terms.

Take this example: A U.S.-based manufacturer held both admitted and non-admitted property policies. After a Mississippi plant was hit by flooding, the carrier’s system reflected $50M in insured property. But the policy’s actual language triggered a co‑insurance penalty because it hadn’t been insured on a replacement cost basis.

The result? A significant payout shortfall for the insured, and inaccurate analytics for the carrier. That one buried clause skewed loss ratios, pricing assumptions, and overall portfolio risk visibility.

The takeaway for insurance portfolio management is clear: System-level summaries can’t be trusted in isolation. True portfolio insight demands deep policy-level analysis—endorsements, valuation clauses, and sublimits—because those fine-print details define real exposure.

The Evolution Story Written in Policy Changes

Your book of business isn’t just a collection of policies, it’s a living archive of how the market evolves. When policy changes are tracked and analyzed over time, they reveal critical signals: shifting risk appetites, emerging exposures, and product performance trends that can reshape your underwriting and portfolio strategy.

Take cyber coverage, for example. Five years ago, most E&S cyber policies included broad ransomware coverage, often without dedicated sublimits. But as ransomware claims surged, carriers responded with narrower definitions, ransomware sublimits and coinsurance, higher deductibles, and stricter minimum-security requirements.

An insurer analyzing these changes at the policy level could identify which adjustments meaningfully reduced losses, which client segments adapted best to the new terms, and where future opportunity lies.

This kind of policy-level intelligence is essential for navigating evolving or complex risks, where successful outcomes depend on understanding not just what was underwritten, but how and why it changed over time.

The Segmentation Revolution: From Broad Buckets to Precision Targeting

Traditional insurance portfolio management often relies on broad categorizations, like class code, state, or account size, that once served their purpose but now fall short in a world of increasingly complex risks. Take “Construction” as an example. This label might cover everything from small-scale home renovation contractors to high-rise builders using advanced smart materials and automation.

Yet the performance delta between those subgroups can be significant. One might represent stable, well-mitigated risk; the other, high exposure with thin margins. Managing both under a single classification distorts pricing assumptions, loss projections, and strategic insights.

With deeper policy-level data, segmentation becomes more precise. Rather than lumping everything under “Construction,” you can identify and analyze emerging micro-segments like:

High-tech builders deploying smart building systems

Traditional contractors with enhanced safety protocols

Renovation specialists focused on environmental remediation

Each group carries a distinct risk profile, demands different underwriting criteria, and supports tailored pricing strategies.

Bottom line: Better data enables better segmentation—and better segmentation enables smarter decisions across pricing, risk alignment, and portfolio strategy.

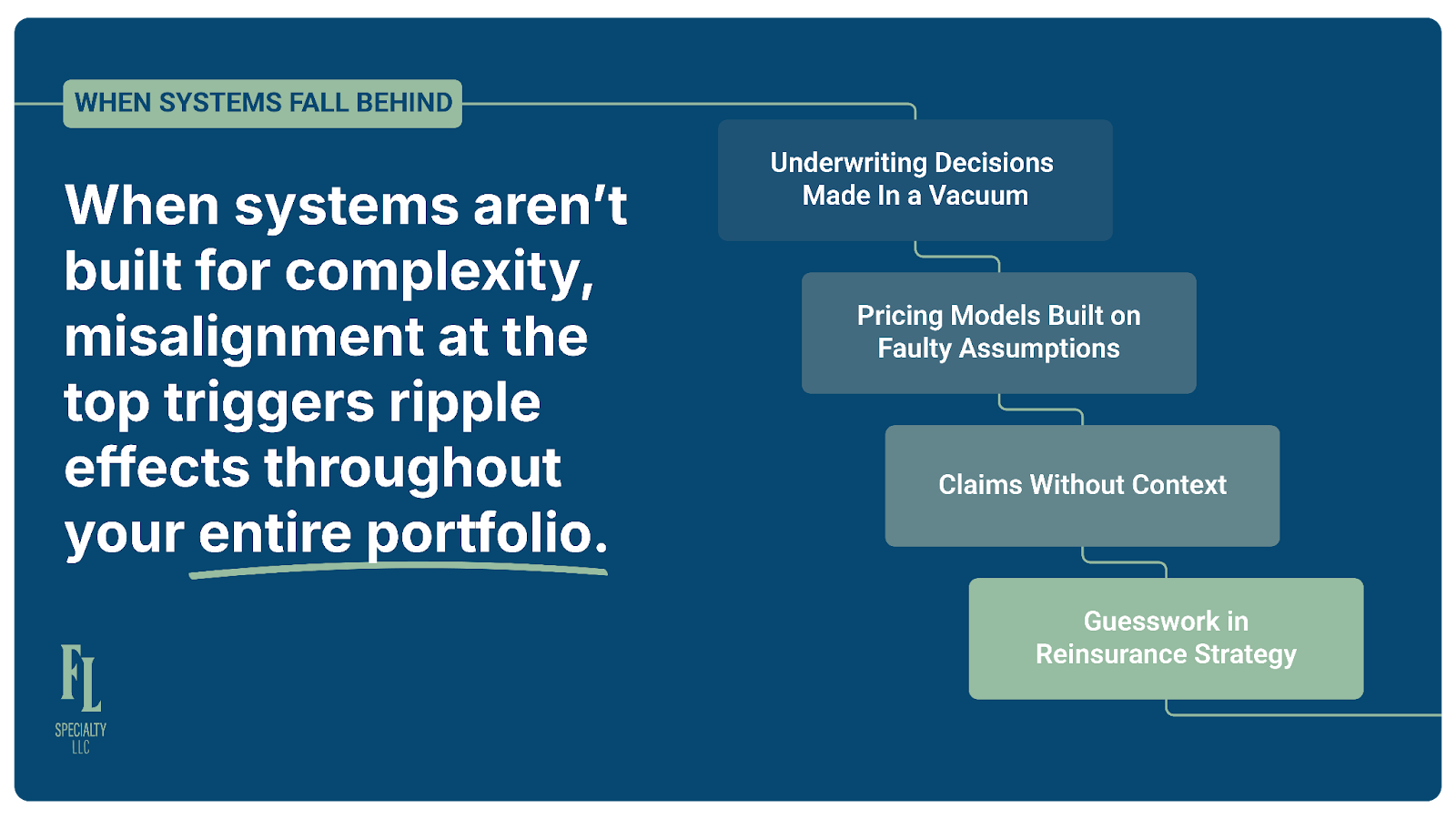

The Technology Gap: When Systems Can't Keep Pace

The biggest challenge in insurance portfolio management today isn’t complexity—it’s misalignment. Most core systems were designed for a different era, one where standardization was the rule and customization the rare exception. These platforms are great at processing templated, commoditized policies. But in the fluid world of E&S insurance, where nuance is everything, they fall short.

That disconnect creates cascading consequences:

Underwriting Decisions Made in a Vacuum: Without easy access to historical policy detail or precedent, underwriters make decisions in isolation, missing opportunities to build on institutional knowledge.

Pricing Models Built on Faulty Assumptions: Models trained on generalized categories rather than precise risk characteristics often misprice coverage—either too conservatively (and lose business) or too loosely (and lose margin).

Claims Without Context: When a loss occurs, claims teams may lack visibility into key coverage modifications, creating friction, overpayment, or unnecessary disputes.

Guesswork in Reinsurance Strategy: Without granular insight into how similar-yet-unique policies accumulate risk, reinsurance placement becomes less data-driven and more speculative.

The good news? The tools to fix this already exist. Many insurers have spent the last decade building foundational data infrastructure to support analytics and digital tools. But now, the focus must shift: enabling those ecosystems to support and scale AI-driven insurance portfolio management.

The question isn't if the technology is available—it’s who will use it strategically, and who will fall behind.

The Fall Line Advantage: Insurance Expertise Meets AI Innovation

At Fall Line Specialty, we’ve built our business on a simple belief: combining deep insurance expertise with cutting-edge AI creates exponentially better outcomes than either alone. Our AI-enabled services don’t replace human judgment—they enhance it by delivering the portfolio-level clarity required to drive confident, data-informed decisions.

We tackle every facet of the insurance portfolio management challenge:

Data Capture: Automated extraction and analysis of policy terms, conditions, and endorsements—across formats, systems, and business lines.

Intelligent Segmentation: Dynamic risk categorization that evolves with your portfolio and shifting market conditions.

Performance Analytics: Granular tracking of profitability drivers, tailored to your strategic goals—whether that’s line of business, client segment, or policy type.

Operational Integration: Seamless incorporation of insights into your existing workflows and decision-making processes.

Because no two portfolios are alike, our solutions are built to adapt to your business, not the other way around. That flexibility ensures you're not just adopting new tools, but unlocking new capabilities.

The result? Operational excellence at AI speed—smarter decisions, faster execution, and dramatically reduced overhead. It’s how the future of insurance portfolio management is being built.

Taking Action

The shift from portfolio approximation to true portfolio precision doesn’t need to happen all at once—but it does need to start. Success begins with clear priorities and a strategic, step-by-step approach.

Ask yourself:

Where are we making decisions without the full picture?

Which system categories mask important differences in risk?

What opportunities are we missing due to lack of portfolio visibility?

The technology is ready. The economic case is strong. And the competitive advantages—faster insights, smarter underwriting, better margins—are already being realized by early adopters.

The only question is: will you lead the transformation, or be left navigating it on someone else’s terms?

Next Up…

Close the clarity gap in your book and turn policy language into a true strategic asset.

Ready to transform your portfolio management approach? Fall Line Specialty's AI-enabled services provide the comprehensive portfolio clarity that drives better decisions at every level. Contact us to learn how we can help you turn portfolio complexity from a challenge into a competitive advantage.