AI for Insurance Brokers and Agencies: From Automation to Transformation

Insurance brokers and agencies are facing a new era of competition—clients expect faster, more personalized service, while digital-first insurtechs are raising the bar on what “modern” looks like. Across industries, 72% of companies now use AI in at least one area of their operations,¹ signaling a massive shift in how business gets done.

But many brokerages still face a critical question: how can AI be applied effectively in a relationship-driven industry like insurance?

The answer lies not in replacing human connection, but in strategically using AI to enhance it. Brokerages that embrace AI for automation, risk insights, and service efficiency—without losing sight of the trust-based relationships that define their value—will be the ones who lead the industry forward.

The Agency Challenge: More Than Just Technology

Insurance brokers and agencies operate in a uniquely complex environment. Unlike carriers that focus primarily on underwriting, brokers must master relationship management, market navigation, and multi-carrier service delivery—often under intense time and margin pressure. These dynamics make adopting AI for insurance brokers less about plug-and-play automation and more about building tailored, strategic solutions.

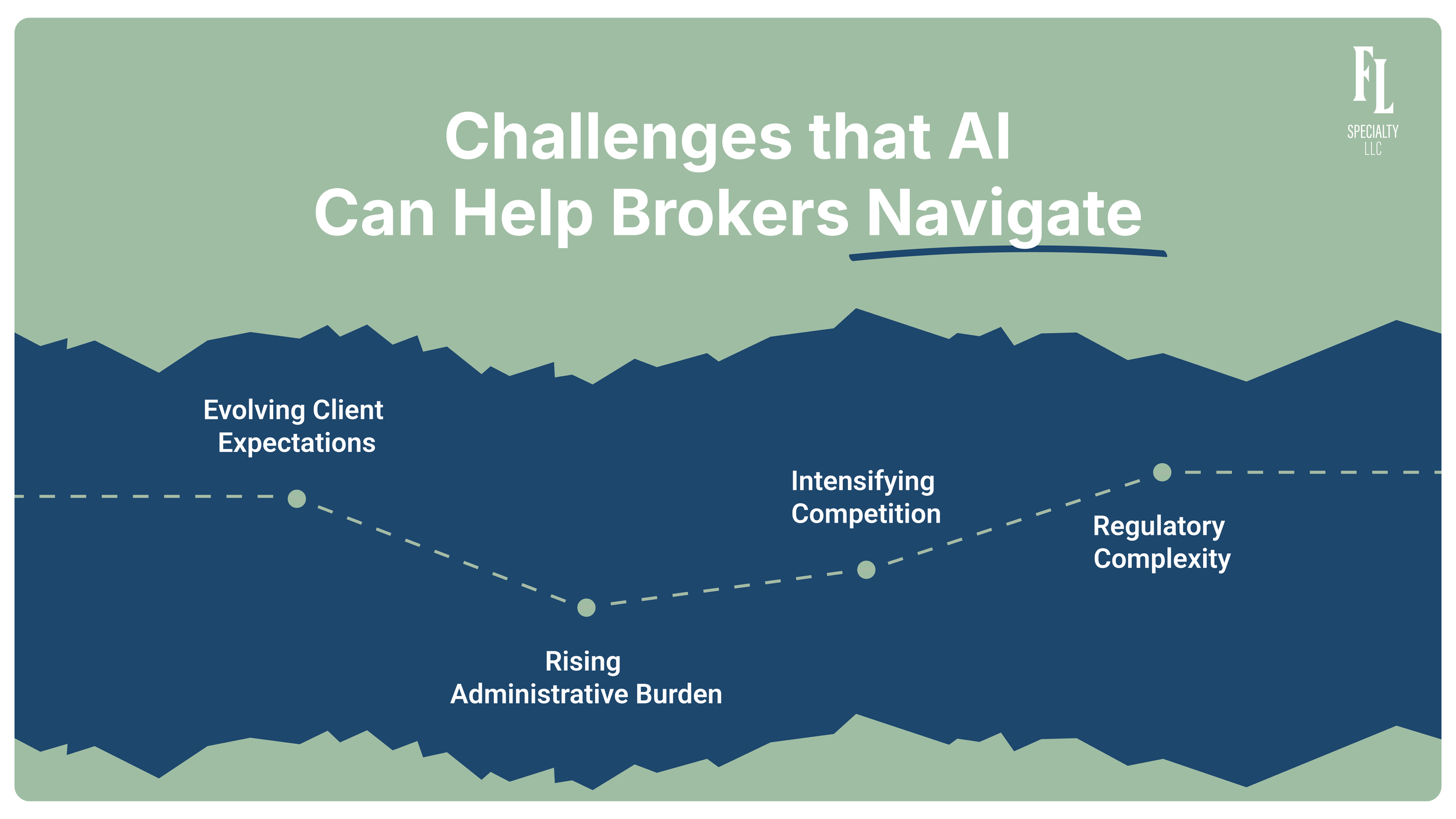

Here are just a few of the challenges that AI must help brokers address:

Evolving Client Expectations: Today’s insurance buyers expect real-time responses, clear communication, and personalized service—standards set by consumer tech platforms. In fact, 67% of clients expect a response from their agent or broker within two hours.² Meeting that demand without sacrificing quality requires smart, scalable support.

Rising Administrative Burden: More than 50% of a broker’s time is spent on administrative tasks, from policy processing and certificate generation to claims coordination and compliance.³ These essential—but non-revenue-generating—tasks create drag on growth and client engagement.

Intensifying Competition: Digital-first brokerages, direct-to-consumer platforms, and even carriers are all encroaching on traditional distribution models. To stand out, brokers must deliver tangible value that justifies human connection and professional expertise.

Regulatory Complexity: Serving multiple carriers across different jurisdictions means managing a web of compliance obligations. Any AI solution must support accuracy, transparency, and auditability in a heavily regulated environment.

The Automation Trap: Why Traditional AI for Insurance Brokers & Agencies Falls Short

Too often, AI for insurance brokers and agencies falls into what we call the automation trap—using technology to replicate existing manual workflows, rather than reimagining how value is delivered. It’s a familiar pattern. In the early days of the internet, many companies simply digitized paper processes instead of transforming their business models.

The same risk applies today. Brokers who treat AI as a shortcut to automate admin work may see short-term wins—but they leave the door wide open for AI-native competitors who redesign the entire client experience from the ground up.

What Automation-Only Looks Like:

Automates policy processing and certificate generation

Provides 10-20% efficiency gains in specific tasks

Maintains existing service model and client interactions

Vulnerable to disruption by AI-native competitors who redesign the entire experience

What Transformation Looks Like:

Reimagines client relationship management and service delivery

Enables 50-200% improvements in both efficiency and service quality

Creates new competitive advantages and client value propositions

Establishes market leadership through enhanced capabilities

Strategic Applications: AI for Insurance Brokers and Agencies

The most successful implementations of AI for insurance brokers and agencies don’t aim to replace human expertise—they enhance it. When thoughtfully applied, AI strengthens relationships, boosts efficiency, and opens new growth opportunities. Below are the highest-impact applications tailored specifically to agency and brokerage operations. And at Fall Line, we’ve developed our Sidekick tools to help clients put these strategies into practice in a practical, actionable way.

Client Relationship Enhancement

Automated Communication Management: Smart systems can manage outreach, reminders, and follow-ups while preserving human touchpoints where they matter most, like renewals, claims, or policy reviews. Fall Line’s Submission Sidekick enables this by automating email-driven workflows such as submitted applications, quote receipts, and client notifications.

Intelligent Customer Service: AI-powered chat and support systems can handle routine inquiries 24/7, freeing agents to focus on high-value, consultative interactions.

Predictive Client Needs Analysis: AI can assess client data, policy history, and industry trends to identify coverage gaps, renewal risks, or expansion opportunities.

Sales and Business Development

Proposal and Quote Management: AI can automate quote comparisons across carriers, identify optimal coverage packages, and generate professional, customized proposals in a fraction of the time. Fall Line’s Policy Sidekick strengthens this process by analyzing policy documents for accuracy and consistency, helping agencies deliver faster and with fewer errors.

Lead Qualification and Prioritization: AI can evaluate lead data to identify high-value prospects, surface buying signals, and recommend engagement strategies.

Market Intelligence: Real-time monitoring of market conditions, competitor movements, and regulatory shifts helps brokers spot new business opportunities or protect existing accounts at risk.

Operational Excellence

Policy Administration: Intelligent systems can handle routine changes, renewals, and compliance tasks, escalating exceptions for human review. Fall Line’s Policy Sidekick supports this with standardized policy review and quality assurance to minimize documentation errors.

Claims Coordination: AI can track claim status across carriers, flag delays or issues, and keep clients informed at every step. Our Submission Sidekick helps by automating intake and notifications, ensuring claims move forward without unnecessary delays.

Document Management: AI-powered tools can categorize, file, and retrieve documents automatically, reducing time spent on admin while maintaining regulatory compliance.

Risk Management and Compliance

Portfolio and Appetite Analysis: AI can deliver deeper insights into books of business and align risks with carriers more effectively. Fall Line’s Analysis Sidekick provides automated portfolio analysis for benchmarking and growth opportunities, while our Appetite Sidekick uses AI-driven appetite matching to reduce placement friction.

Regulatory Monitoring: AI systems can monitor changing regulations across jurisdictions, flagging updates that impact agency operations or client coverage needs.

Error Prevention: Automated systems can identify coverage conflicts, missing documentation, or policy inconsistencies before they become costly issues.

Performance Analytics: AI can deliver advanced insights on agency performance, client satisfaction, and market trends, helping leaders make more informed decisions.

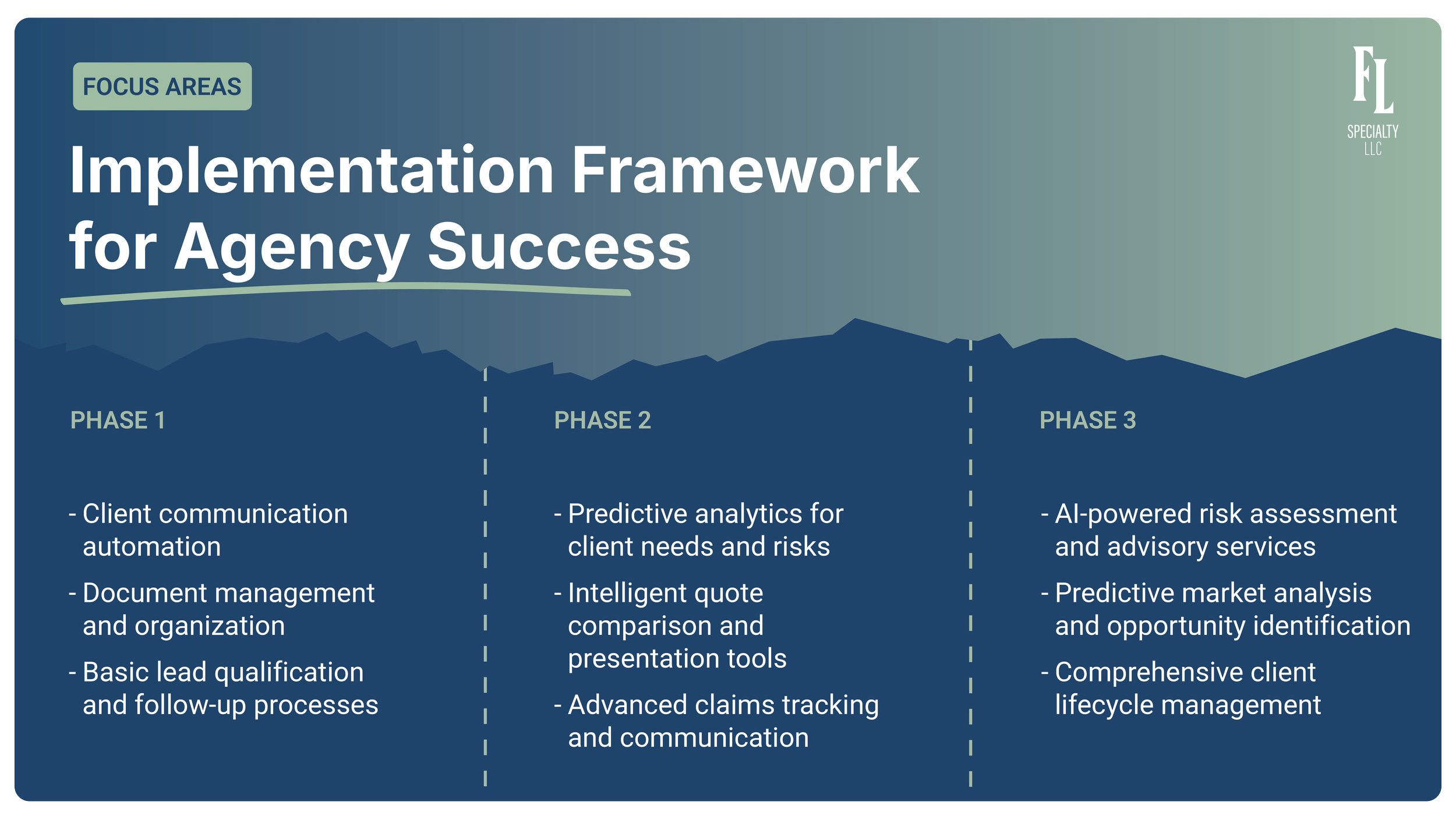

Implementation Framework for Agency Success

Drawing on lessons from successful digital transformations and current AI leaders, we've developed a practical, phased framework to help insurance brokers and agencies unlock the value of AI—while managing implementation risk and maximizing ROI.

This step-by-step roadmap allows agencies to build momentum, layer in capabilities strategically, and align each phase with measurable business impact.

Phase 1: Foundation and Quick Wins (Months 1-6)

Focus Areas:

Client communication automation (email responses, appointment scheduling)

Document management and organization

Basic lead qualification and follow-up processes

Success Metrics:

Reduced response time to client inquiries

Increased agent availability for consultative activities

Improved client satisfaction scores

Phase 2: Enhanced Capabilities (Months 6-18)

Focus Areas:

Predictive analytics for client needs and risks

Intelligent quote comparison and presentation tools

Advanced claims tracking and communication

Success Metrics:

Increased cross-selling and up-selling success rates

Faster quote turnaround times

Improved client retention rates

Phase 3: Competitive Differentiation (Months 18-36)

Focus Areas:

AI-powered risk assessment and advisory services

Predictive market analysis and opportunity identification

Comprehensive client lifecycle management

Success Metrics:

Market share growth in target segments

Premium volume increases

Enhanced profit margins through efficiency gains

The Fall Line Advantage: Strategic Implementation of AI for Insurance Brokers and Agencies

The challenge facing most agencies and brokerages is clear: they need AI capabilities to remain competitive, but they cannot afford to jeopardize the client relationships and service quality that define their business.

This is the classic innovator’s dilemma: the strength of current operations can make transformation harder to initiate. That’s why Fall Line Specialty’s Strategic Agency Operations is a purpose-built solution to help agencies and brokerages adopt AI for insurance brokers in a way that’s both measured and sustainable.

Phased Implementation Strategy:

Begin with low-risk, high-impact applications that immediately improve client service

Gradually expand AI capabilities while maintaining existing client relationships

Measure results at each phase to ensure positive ROI before advancing

Industry-Specific Solutions:

AI tools designed specifically for agency and brokerage workflows

Integration capabilities with existing agency management systems

Compliance frameworks that address regulatory requirements across multiple jurisdictions

Change Management Support:

Training programs that help staff adapt to AI-enhanced workflows

Communication strategies that help clients understand value enhancements

Performance metrics that demonstrate tangible business improvements

Risk-Managed Transformation:

Parallel system implementation that protects existing operations

Gradual transition processes that minimize disruption

Continuous monitoring and adjustment to ensure successful adoption

With Fall Line’s approach, brokers don’t have to choose between innovation and stability. We help you strategically adopt AI, unlock new capabilities, and strengthen your competitive edge—without sacrificing the personal service that sets your agency apart.

Real-World Applications: How AI Transforms Daily Operations

To understand the impact of AI for insurance brokers, look no further than one of the most time-consuming and critical workflows: the renewal process. AI doesn’t just speed things up—it reshapes how brokers deliver value.

Traditional Renewal Process:

Agent manually reviews expiring policies

Contacts clients 60-90 days before renewal

Requests updated information and coordinates with carriers

Processes renewals individually with limited market comparison

AI-Enhanced Renewal Process:

System identifies renewal opportunities 120+ days in advance

Automatically requests competitive quotes from appropriate carriers

Analyzes client risk profile changes and suggests coverage adjustments

Prepares comprehensive renewal presentations with market comparisons

Enables agent to focus on strategic consultation rather than administrative tasks

The result: Improved client outcomes, higher retention rates, and more profitable renewals with less administrative burden.

This is just one example of how AI enables brokers to operate smarter, faster, and with greater impact—without compromising the human touch that builds lasting client relationships.

Strategic Implications for Agency Leaders

The convergence of rising client expectations, competitive pressure, and rapidly evolving AI capabilities presents both a challenge and a powerful opportunity for forward-thinking insurance agencies and brokerages. The adoption of AI for insurance brokers is no longer a tech experiment—it’s becoming a strategic imperative.

First-Mover Advantages: Agencies that embrace AI early and strategically will gain a decisive edge over slower-moving competitors. Improved efficiency, faster response times, and proactive service models translate into increased market share and a sustainable competitive advantage.

Client Relationship Enhancement: AI doesn’t replace the advisor, it amplifies their value. By offloading routine, time-consuming tasks, brokers can focus on strategic consultation, deeper engagement, and building trust—all while delivering a more modern, responsive experience.

Operational Scalability: With the right AI systems in place, agencies can handle more clients and greater complexity without a proportional increase in staffing. This creates a scalable growth model that protects margins while expanding reach.

Market Positioning: Agencies that showcase AI-driven capabilities position themselves as innovators, a signal that resonates with tech-savvy clients, next-generation talent, and strategic partners alike. It’s not just about what you do—it’s how forward you look while doing it.

Looking Forward: The Future of Agency Success

The insurance agency and brokerage business has always been built on relationships, expertise, and trust. AI doesn’t replace these foundations—it enhances them. The agencies that will lead in the years ahead are those who use AI not as a shortcut, but as a strategic advantage to deliver smarter service, deeper insights, and better outcomes.

For agency leaders, the question isn’t if you should adopt AI—but how soon you can do it strategically, before the market tilts permanently in favor of more agile, tech-enabled competitors.

AI for insurance brokers and agencies isn’t just a tool for efficiency—it’s the engine of the next era of growth, differentiation, and leadership.

The future is already in motion. The time to begin your transformation is now.

Ready to transform your agency operations with AI while maintaining the client relationships that drive your success? Contact Fall Line Specialty to learn how our Strategic Agency Operations can help your agency capture AI value while managing implementation risk.

Next Up…

Turn AI from a buzzword into better renewals, faster responses, and a stronger client experience.

References

McKinsey & Company. "The state of AI: How organizations are rewiring to capture value." March 12, 2025. https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

Insurance Business America. "Client Service Expectations in the Digital Age." 2024.

Boston Consulting Group. "How Insurers Can Supercharge Their Strategy with AI." April 15, 2025. https://www.bcg.com/publications/2025/how-insurers-can-supercharge-strategy-with-artificial-intelligence

TDAN. "Digital Transformation in Insurance: Overcoming Legacy Challenges." 2025. https://tdan.com/digital-transformation-in-insurance-overcoming-legacy-challenges/32345

Additional Reading

Harvard Business Review. "Discovery-Driven Digital Transformation." May 1, 2020. https://hbr.org/2020/05/discovery-driven-digital-transformation

Prosci. "Digital Transformation in the Insurance Industry: A Change Management Guide." June 17, 2025. https://www.prosci.com/blog/digital-transformation-in-insurance-industry

Boston Consulting Group. "AI Adoption in 2024: 74% of Companies Struggle to Achieve and Scale Value." October 2024. https://www.bcg.com/press/24october2024-ai-adoption-in-2024-74-of-companies-struggle-to-achieve-and-scale-value