AI at the Helm: How Private Equity Insurance Roll-Ups Are Evolving in 2025

I. Introduction

The traditional private equity insurance roll-up playbook for Managing General Agents (MGAs) is rapidly approaching its limits in 2025. With valuations at historic highs—platform MGAs now commanding 18x EBITDA multiples compared to 10x just five years ago—simply acquiring and consolidating is no longer sufficient to generate attractive returns.

Real-world evidence from recent transactions demonstrates that traditional approaches face critical challenges beyond financial engineering. The most successful PE firms are now embracing data and AI-driven operational transformation to extract sustainable value from their MGA portfolios.

As we'll explore through documented case studies and market analysis, PE investors must navigate hidden liabilities, complex integrations, and talent retention challenges that can derail even carefully structured acquisitions. Firms that develop sophisticated data utilization and AI capabilities are emerging as the clear winners in this evolving landscape.

II. The Current State: High Valuations Meet Real-World Challenges

Within the broader landscape of private equity insurance roll-ups, MGAs continue to attract significant PE investment despite economic headwinds. The sector's resilience is understandable: MGAs sourced $71 billion in direct premiums in 2022, representing a 10% compound annual growth rate since 2010, and the broader industry revenue is projected to increase at an annual rate of 3.5% through 2028. This growth trajectory, combined with high margins (typically 20-30% EBITDA), low capital intensity, and recurring revenue streams, creates a compelling investment thesis.

However, the market faces sobering realities beyond these headline numbers. In 2024, while transaction volume remained high with 847 announced deals (the third-highest on record), acquisition multiples continued their upward climb despite rising interest rates and economic uncertainty. [1,6]

Understanding insurance risks is an essential part of any deal-related due diligence. A private equity (PE) firm hired Hylant to perform a quality of risk study to help it understand the potential risks and insurance-related costs of a planned acquisition of a roofing company before the deal was signed. In a case study provided by Hylant, they illustrate the hidden risks beneath surface-level valuations. During due Hylant uncovered $367,800 in hidden insurance liabilities that would have materially impacted the investment thesis had they gone undetected. [12]

This example, while from an adjacent sector, highlights a universal truth in the MGA space: thorough operational due diligence is essential for avoiding post-acquisition surprises that can erode expected returns.

As one PE investor noted in a recent industry forum, "The days of buying at 10x EBITDA, implementing basic back-office synergies, and exiting at 14x are over. Today's valuations require a fundamentally different approach to value creation"

III. The Value Creation Evolution: From Financial Engineering to Operational Intelligence

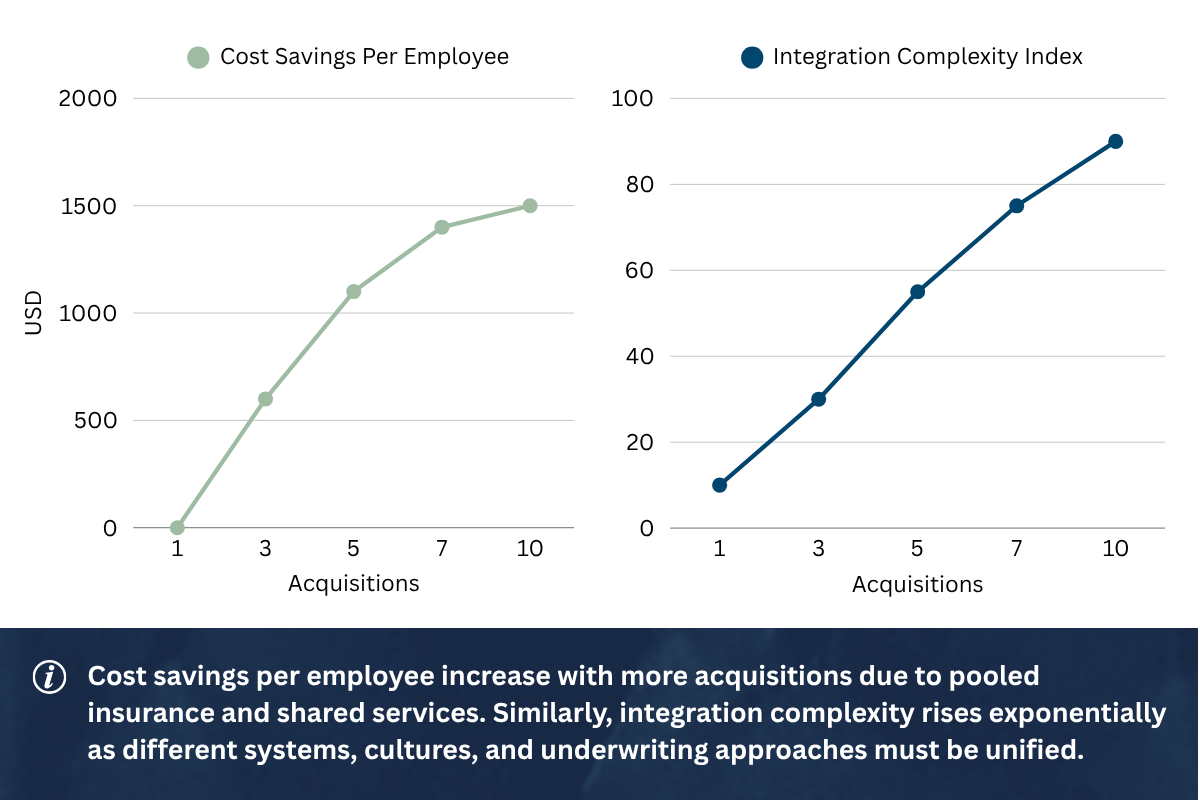

The evolution of value creation strategies in private equity insurance roll-ups is strikingly illustrated by Oswald Companies' innovative approach for a large PE firm. Instead of focusing solely on traditional back-office consolidation, Oswald created a pooled health insurance model across 23 portfolio companies, reducing per-employee premiums by $1,100 and generating immediate operational savings while improving benefits consistency. [13]

This case exemplifies the shift from financial engineering to operational innovation—a transition necessary for justifying today's premium valuations. [3]

From Back-Office Efficiency to Strategic Value Creation

Traditional approaches to value creation in MGA roll-ups have centered around administrative consolidation: streamlining accounting, HR, and generic technology platforms. While these tactics remain relevant, they're increasingly commoditized and insufficient for generating differential returns.

Evidence from Brookline Capital's TPA roll-up strategy demonstrates both the opportunity and challenge: while guiding a health insurer to acquire third-party administrators nationally diversified revenue streams, the transition from fully insured to self-funded plans created significant operational complexity that required sophisticated integration capabilities

Today's leading PE firms are moving beyond cost-cutting to focus on:

Customer data activation: Converting dormant customer information into actionable insights for cross-selling, retention, and expansion

Portfolio-level synergies: Creating capabilities that scale across multiple acquisitions rather than optimizing individually

Market responsiveness: Developing platforms that adapt to changing market conditions and capacity provider requirements in near real-time. [2,3]

Operationalizing Intelligence for Competitive Advantage

The distinction between data collection and data utilization represents a critical inflection point for PE firms in the MGA space. Many acquisitions now begin with the construction of "data lakes"-centralized repositories of information from across the portfolio. However, simply aggregating data creates little incremental value.

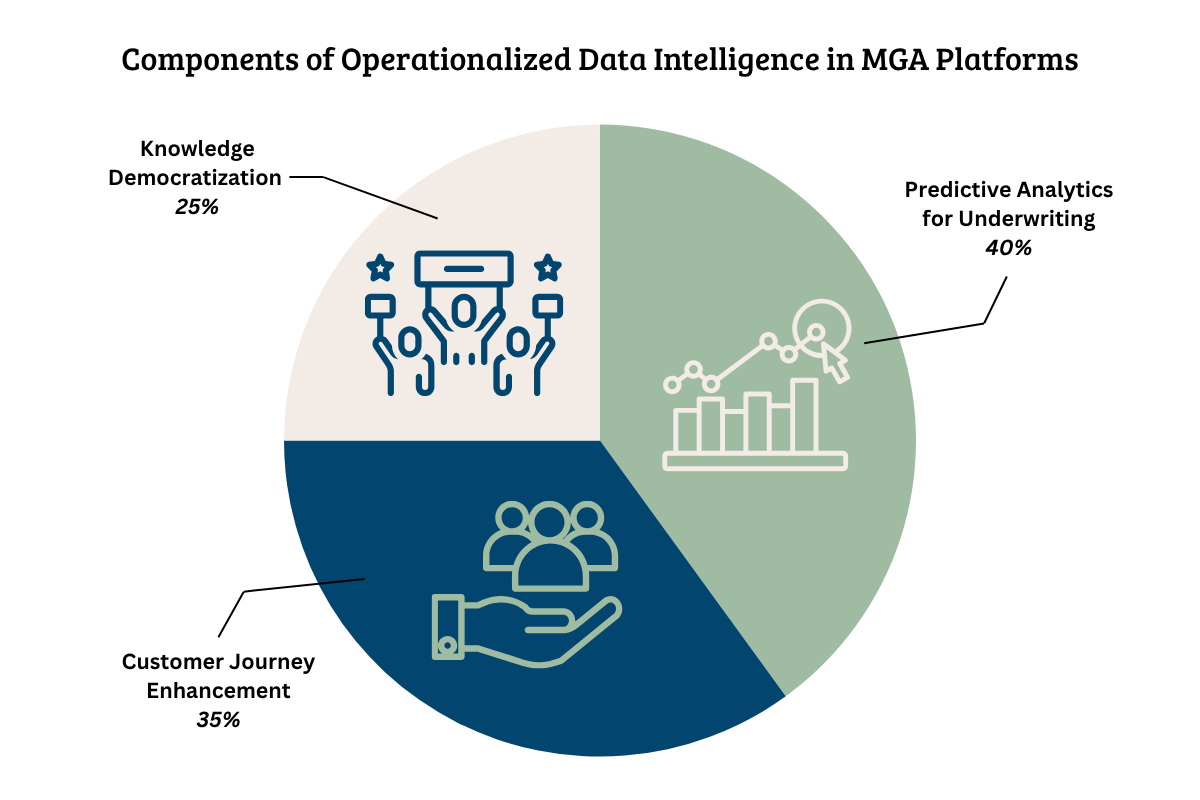

The competitive advantage emerges from operationalizing this intelligence through:

Predictive analytics for underwriting optimization: Identifying patterns across the portfolio that individual MGAs couldn't detect alone

Customer journey enhancement: Using behavioral data to remove friction points and improve conversion rates

Knowledge democratization: Making specialized underwriting expertise accessible throughout the organization. [2]

As one senior executive at a PE-backed MGA platform noted, "We built a centralized data warehouse two years ago, but it's only in the last six months that we've created the analytical capabilities to derive actionable insights that materially impact our growth trajectory". [2]

IV. Real-World Transformation Examples

Major PE transactions in the insurance space illustrate both the potential and the challenges of scaling through acquisition.

Scale vs. Complexity Trade-offs

KKR's investment of over $1 billion to consolidate ownership of USI Insurance Services demonstrates the continuing appeal of scale in the insurance distribution landscape. As a leader in risk management and employee benefits, USI has leveraged its size to enhance market positioning and cross-selling capabilities.

Similarly, Stone Point Capital's acquisition of a minority stake in Truist Insurance Holdings (the sixth-largest U.S. broker) in partnership with Mubadala Investment Company represents a strategic move to expand geographic reach and diversify product lines.

However, both transactions face a common challenge: balancing growth ambitions with integration complexity in an increasingly fragmented market. [1,6]

The traditional approach of leaving acquired companies largely independent while capturing basic corporate function synergies becomes progressively less effective as valuations rise. The mathematical reality is unavoidable: when paying 18x EBITDA, modest back-office consolidation savings of 1-2% simply don't move the needle on returns. The path to value creation must include more substantive operational transformation. [1]

The Data Advantage in Practice

Forward-thinking PE firms are addressing these challenges through data-driven approaches that accelerate integration while minimizing disruption. Key strategies include:

Unified customer data platforms: Creating single views of customers across portfolio companies to enable seamless cross-selling and service

AI-powered pattern recognition: Identifying underwriting trends and market shifts faster than human analysis alone could detect

Digital product development: Using portfolio-wide data to rapidly create and test new insurance products and services. [2,5]

One PE-backed MGA platform has implemented an AI-driven customer segmentation system that analyzes behavioral patterns across its seven acquired companies. This system identified a significant cross-selling opportunity for cyber coverage among property insurance clients that had been previously overlooked, generating an incremental $14M in premium within twelve months.

Another example comes from a PE firm's integration of three specialty MGAs operating in adjacent but non-overlapping markets. By implementing a shared data architecture and analytical framework, they reduced new product development time by 47% and increased successful capacity provider submissions by 31%. [2]

V. The Talent Retention Crisis: Beyond Traditional Solutions

Talent retention represents perhaps the most significant challenge in private equity insurance roll-ups, where the success of each acquisition often hinges on retaining key underwriting talent. According to industry research, 75% of portfolio company leaders consider talent retention to be their biggest challenge, with a particular focus on underwriting expertise.

The insurance industry faces a dual talent challenge: an aging workforce (with 50% of current insurance professionals expected to retire by 2030) and limited appeal to younger generations. This demographic pressure compounds the usual post-acquisition retention concerns.

AI augmentation offers a promising solution to this persistent problem. Rather than replacing experienced underwriters and insurance professionals, advanced analytical tools can:

Enhance productivity: Automating routine aspects of underwriting allows experts to focus on complex decisions

Reduce key person risk: Capturing and codifying institutional knowledge makes organizations less dependent on individual experts

Create more attractive roles: Technology-enhanced positions appeal to both experienced professionals and younger talent. [2,4]

One PE-backed MGA implemented an AI assistant for senior underwriters that reduced administrative documentation by 62% while increasing consistency in risk evaluation. The result: improved retention of senior talent and accelerated development of junior team members who gained access to previously tacit knowledge. [2] As private equity insurance roll-ups grow more data-driven, retaining the underwriting expertise that powers these AI-enabled platforms becomes a strategic imperative.

VI. New Operating Models for Sustainable Returns

The evolving MGA landscape requires new operating models that can deliver sustainable returns despite premium acquisition costs.

The Integration Complexity Reality

The integration complexity increases exponentially with each acquisition, particularly when targets operate different technology systems, underwriting approaches, and client service models. Traditional "hands-off" PE approaches that preserve operational independence limit value creation potential.

Leading PE firms are addressing this challenge by creating standardized integration playbooks and centers of excellence that can be deployed across acquisitions, reducing both time-to-value and disruption risk. [1,3]

Technology as the Integration Accelerator

Technology infrastructure represents both a significant challenge and opportunity in MGA integrations. PE firms adopting modern architectural approaches can dramatically accelerate value realization:

API-first design: Building flexible interfaces between systems rather than forcing complete platform standardization

Microservices architecture: Creating modular components that can be deployed selectively across the portfolio

Cloud-native infrastructure: Enabling scalable, cost-effective technology deployment without large capital investments. [2,3]

One PE-backed insurance platform implemented a "digital integration layer" that connected disparate systems across five acquired MGAs without requiring immediate replacement of core platforms. This approach reduced integration costs by 38% while accelerating time-to-value by 7 months compared to previous acquisitions.

Data standardization represents another crucial accelerator. By establishing common data models and taxonomies across portfolio companies, PE firms can enable analytics and insights that were previously impossible, even when underlying systems remain different. [2,3]

VII. Strategic Recommendations Based on Real-World Evidence

Based on documented case studies and market analysis, we recommend four strategic imperatives for PE firms investing in the MGA space:

1. Comprehensive Due Diligence 2.0

The Hylant case study demonstrates the critical importance of thorough pre-acquisition assessment. Modern due diligence must extend beyond financial metrics to include:

Insurance-specific liability audit: Uncovering hidden risks and compliance issues before they impact returns

Data infrastructure assessment: Evaluating the quality, accessibility, and integration potential of existing data assets

AI readiness evaluation: Assessing the maturity of analytical capabilities and identifying enhancement opportunities

The valuation premium for "data-ready" acquisitions is justified by significantly reduced integration costs and accelerated time-to-value. As one PE executive noted, "We'd rather pay 15% more for a company with clean, accessible data than deal with the integration headaches of poorly structured information". [3,6]

2. Portfolio-Level Value Creation Strategies

Oswald's pooled insurance model demonstrates how thinking beyond individual acquisitions creates multiplicative benefits. Effective portfolio-level strategies include:

Shared service platforms: Creating specialized centers of excellence rather than basic administrative consolidation

Cross-portfolio data exchanges: Establishing secure mechanisms for sharing insights while maintaining appropriate boundaries

Joint market development: Leveraging combined scale to access markets unavailable to individual MGAs

One PE firm established a dedicated data science team that serves all portfolio companies, providing specialized expertise none could afford individually. This approach has generated 15% improvement in pricing accuracy and 23% reduction in claims leakage across the portfolio. [2,3]

3. Risk Mitigation Through Technology

The concentration risk inherent in MGA models-where businesses typically rely on 2-3 capacity providers-can be partially mitigated through technical capabilities:

Performance transparency: Creating real-time dashboards that demonstrate underwriting quality to capacity providers

Predictive portfolio management: Using AI to identify potential capacity issues before they affect relationships

Diversification enablement: Leveraging data to expand into adjacent markets with different capacity dynamics

One PE-backed MGA platform implemented an AI-powered performance monitoring system that detected subtle shifts in loss patterns six months earlier than traditional actuarial reviews, enabling proactive communication with capacity providers and preserving critical relationships. [2]

4. Talent Strategy Evolution

The documented talent retention challenge requires fundamental rethinking of human capital strategies:

Technology augmentation: Providing AI-enhanced tools that make experienced professionals more productive and valuable

Cross-portfolio career paths: Creating development opportunities beyond individual companies to retain talent within the portfolio

Progressive workplace culture: Emphasizing flexibility, innovation, and continuous learning to attract younger generations. [4]

A PE firm specializing in specialty insurance implemented an "expertise capture" initiative that documented underwriting guidelines from senior professionals into an AI-assisted platform. This reduced onboarding time for new underwriters by 41% while providing a compelling reason for experienced staff to remain engaged. Gallagher Bassett also offers additional insights in their article, How MGAs and PAs can win the battle for talent. [4]

VIII. The Future Landscape: Implications for 2025 and Beyond

The evolution of private equity insurance roll-ups will continue accelerating as AI capabilities mature and competition for quality assets intensifies. Several emerging trends warrant attention:

The Increasing Cost of Traditional Approaches

PE firms continuing to rely on basic consolidation strategies will face compressed returns as acquisition multiples remain elevated. Without operational transformation capabilities, these investors may find themselves priced out of quality acquisitions or forced to accept subpar returns.

The case studies from KKR, Stone Point Capital, and others demonstrate that even large, sophisticated investors recognize the need for enhanced operational capabilities to justify current valuations. [6,7]

Early Mover Advantage in AI/Data Capabilities

PE firms that invest in AI and data capabilities now will establish substantial competitive advantages. These early movers will:

Identify superior acquisition targets: Using data-driven methods to uncover hidden value opportunities

Integrate more efficiently: Reducing time-to-value and minimizing disruption costs

Create proprietary insights: Generating portfolio-wide intelligence unavailable to competitors

One PE firm with advanced data capabilities reportedly identified a specialty MGA with significantly underpriced operations relative to its data assets. Their acquisition at 14x EBITDA appeared expensive to market observers, but the firm's ability to rapidly activate dormant customer data generated 27% premium growth in the first year, well beyond standard market expectations. [8]

The Emerging Competitive Gap

As AI capabilities mature, a performance gap will emerge between technology-enabled and traditional operators. This divergence will manifest in:

Customer acquisition efficiency: Data-driven firms achieving lower customer acquisition costs (CAC) and higher conversion rates

Underwriting performance: AI-augmented operations delivering better loss ratios and capacity stability

Talent magnetism: Technology-forward environments attracting both experienced and emerging talent

The implications for PE investors are profound: those without sophisticated data and AI capabilities will increasingly find themselves subject to adverse selection, acquiring targets that more technically advanced competitors have passed over. [9,10,11]

IX. The Path to Sustainable Value Creation

The evidence from real-world case studies and market analysis points to an inescapable conclusion: operational transformation through data and AI capabilities is essential for sustainable value creation in today's MGA acquisition landscape.

Traditional private equity insurance roll-ups—built solely on financial engineering and basic consolidation—can no longer generate appropriate returns at current valuation levels. PE firms must develop or acquire sophisticated capabilities that transform how their portfolio companies understand customers, manage risk, and develop new products.

The most successful investors will be those who view technology not merely as a cost center to be optimized but as a strategic enabler of value creation. They will build data architectures and AI systems that amplify human expertise rather than replacing it, creating both operational efficiency and enhanced competitive positioning.

For MGAs, the message is equally clear: partnerships with PE firms that offer technological transformation alongside capital will deliver superior outcomes compared to those offering financial resources alone.

The future belongs to those who recognize that in the data age, the true source of sustainable value lies not in what you own, but in what you know — and how effectively you apply that knowledge.

Next Up…

See how data and AI unlock portfolio value, improve underwriting discipline, and de-risk ambitious roll-up strategies.

References

[1] McKinsey & Company. (2025). Global Private Markets Report 2025. https://www.mckinsey.com/industries/private-capital/our-insights/global-private-markets-report

[2] Virtasant. (2024, September 3). AI operational efficiency boosts private equity ROI. https://www.virtasant.com/ai-today/ai-operational-efficiency-private-equity

[3] STS Capital. (2024, October 15). Unlocking hidden opportunities in insurance sector investments. https://stscapital.com/insurance-sector-investment-opportunities/

[4] Gallagher Bassett. (n.d.). How MGAs and PAs can win the battle for talent. https://insurers.gallagherbassett.com/insights/how-mgas-and-pas-can-win-the-battle-for-talent/

[5] IMAA Institute. (2023, October 11). AI and the future of mergers and acquisitions. https://imaa-institute.org/blog/the-future-role-of-artificial-intelligence-in-mergers-and-acquisitions/

[6] Clyde & Co. (2025, March 13). New mergers & acquisitions activity report from Clyde & Co. https://insurance-edge.net/2025/03/13/new-mergers-acquisitions-activity-report-from-clyde-co/

[7] West Monroe Partners. (2025, April 1). Private equity firms and insurers are betting on different futures. https://www.westmonroe.com/insights/insurance-m-a-private-equity-firms-and-insurers-are-betting-on-different-futures

[8] DealPotential. (2025, April 15). How AI & company data are shaping private equity in 2025. LinkedIn. https://www.linkedin.com/pulse/how-ai-company-data-shaping-private-equity-2025-dealpotential-qickf

[9] VCI Institute. (2025, January 14). Top private equity trends for 2025: AI, blockchain, and ESG. https://www.vciinstitute.com/blog/the-top-7-trends-in-private-equity-for-2025

[10] Federato. (2025, April 2). AI & underwriting: 3 ways MGAs can increase profitability. https://www.federato.ai/articles/increase-mga-profitability-with-ai

[11] Insurance Thought Leadership. (2025, March 11). Reinforcing commercial underwriting with AI assistants. https://www.insurancethoughtleadership.com/ai-machine-learning/reinforcing-commercial-underwriting-ai-assistants

[12] https://hylant.com/insights/case-studies/pe-firm-uncovers-hidden-risks-before-acquisition