AI and Risk Management: How Insurers Can Lead the Next Innovation Cycle

In every technological revolution, some industries move fast while others lag behind. During the internet era, healthcare took nearly 15 years to meaningfully adopt digital technologies—electronic health records didn’t gain widespread traction until the mid-2000s.¹ By contrast, retail transformed in just five years, with e-commerce pioneers like Amazon completely redefining the consumer experience by 2000.²

For insurance executives navigating today’s AI transformation, these historical patterns offer more than just context—they reveal market opportunities hiding in plain sight. Today, 72% of companies worldwide use AI in at least one part of their operations—up from 55% just two years ago.³

And here’s where the opening emerges: as industries adopt AI at different speeds and in different ways, new risks, exposures, and protection needs are surfacing every day. This intersection of AI and risk management opens the door for forward-thinking insurers to create innovative products and solutions that not only support clients, but also shape the AI innovation cycle itself.

The question is: in this transformation, will your organization be a fast adopter—or risk lagging behind?

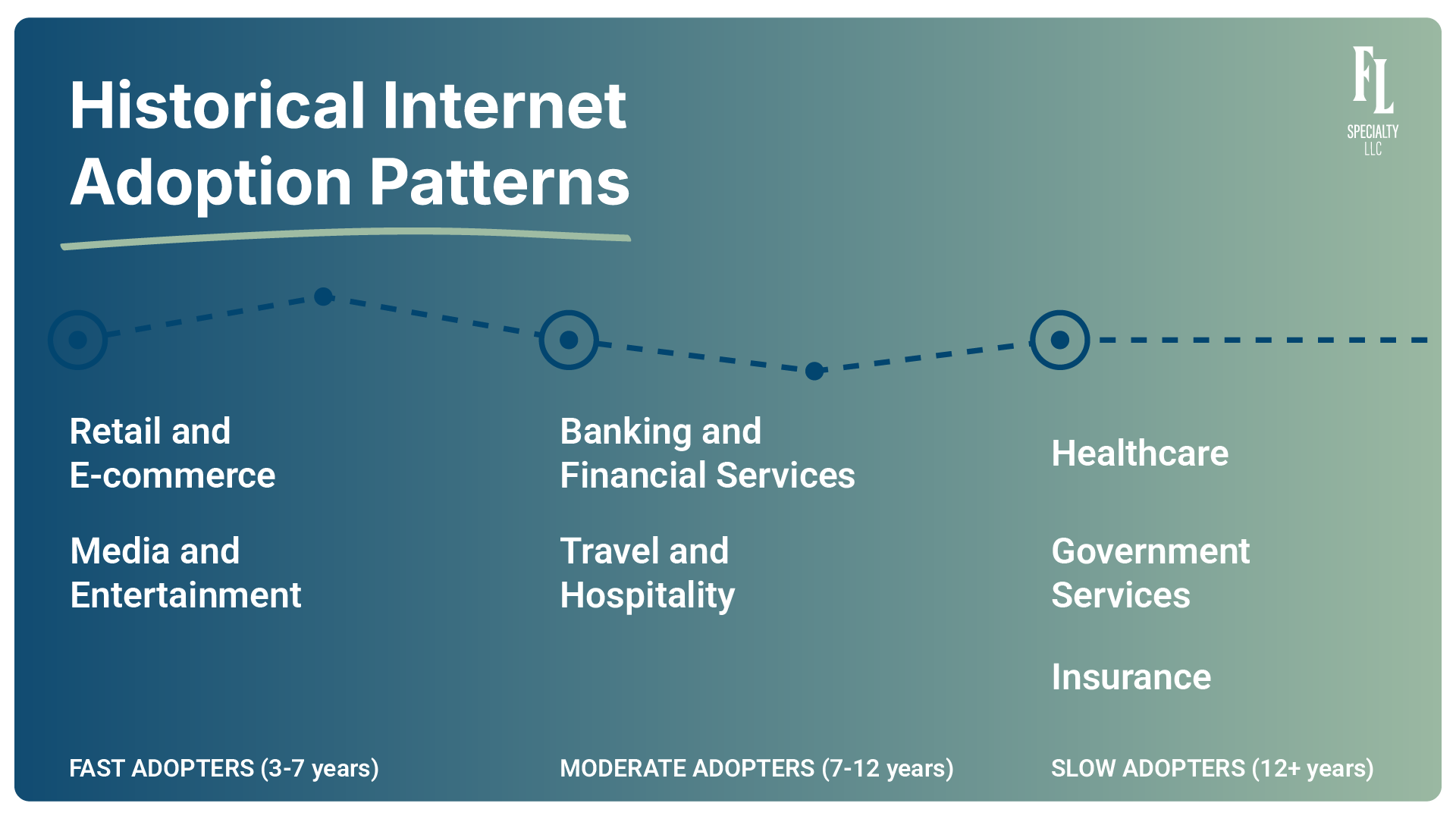

The Great Industry Divide: Historical Internet Adoption Patterns

When the internet first emerged, not every industry jumped in at once. Adoption followed clear patterns—shaped by regulation, risk tolerance, and competitive pressure. Understanding those patterns offers valuable insight into how industries are embracing AI today—and the new risks and insurance opportunities that come with it.

Some industries moved fast:

Retail & E-commerce broke barriers in the late '90s, unlocking new risks like cyberattacks and supply chain exposures.

Financial Trading rapidly digitized, creating demand for system reliability coverage.

Media & Entertainment saw streaming take off—raising IP and piracy concerns.

Others took longer:

Banking embraced online services by the mid-2000s, requiring robust cyber and operational risk coverage.

Healthcare and Government didn’t fully digitize until the 2010s, bringing HIPAA and cyber liability to the forefront.

Insurance itself moved slowly—but gained a unique vantage point on emerging digital risk.

AI and Risk Management: New Exposures, New Opportunities

AI adoption is outpacing past tech shifts—and it’s creating new forms of risk that insurers are racing to understand.

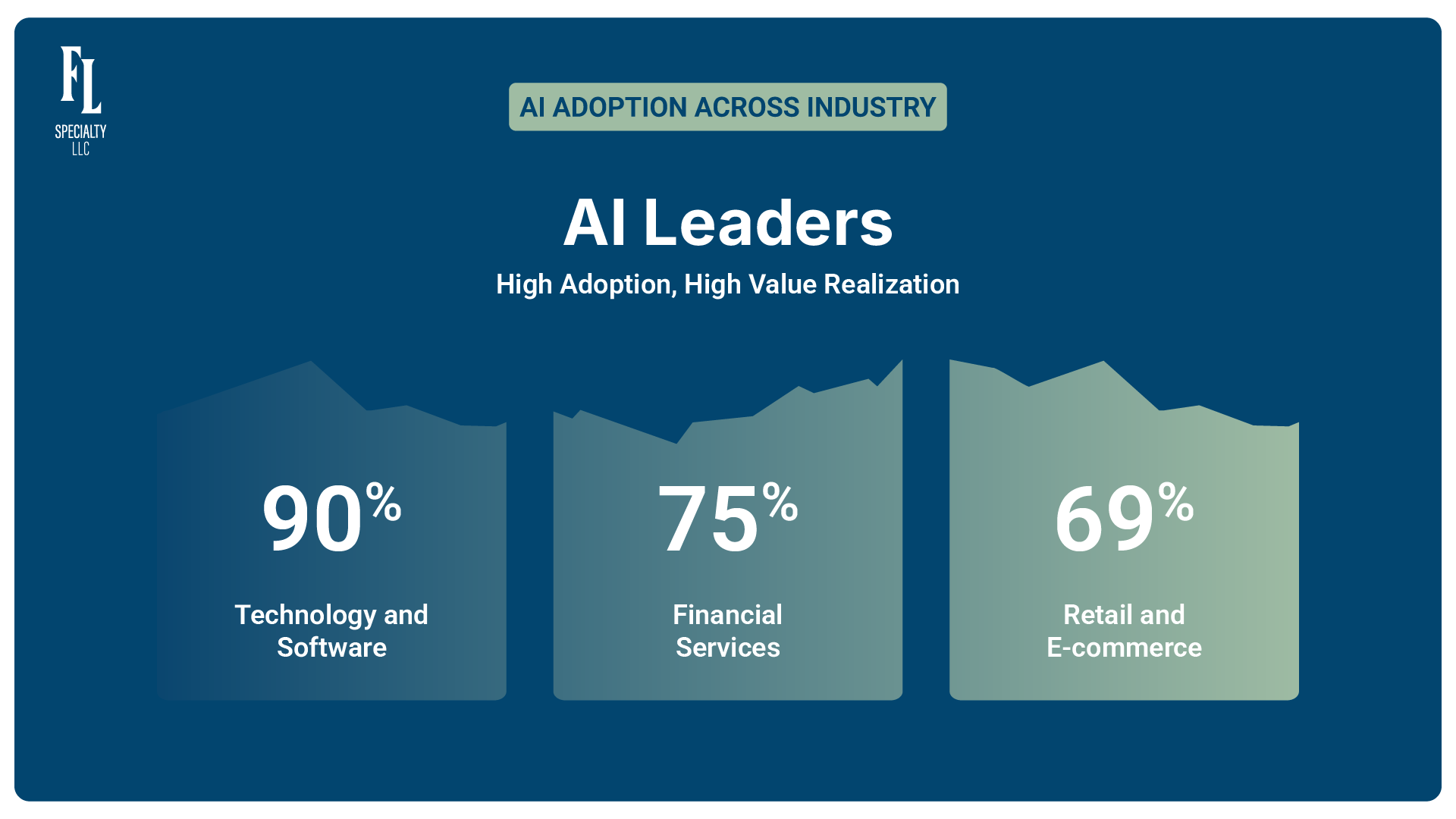

AI Leaders (High Adoption, High Value Realization):

Technology and Software: 90% of companies have adopted AI tools, with productivity gains of 20–40% in software development. But that speed creates liability risks—from IP disputes to algorithmic accountability.⁷

Financial Services: 75% of banks and fintechs use AI in fraud detection, trading, and customer service. These use cases require new E&O policies and protection against algorithmic bias.⁸

Retail and E-commerce: 69% of retailers using AI agents report major revenue growth. But personalization at scale brings growing risks—privacy issues, discrimination claims, and regulatory scrutiny.⁹

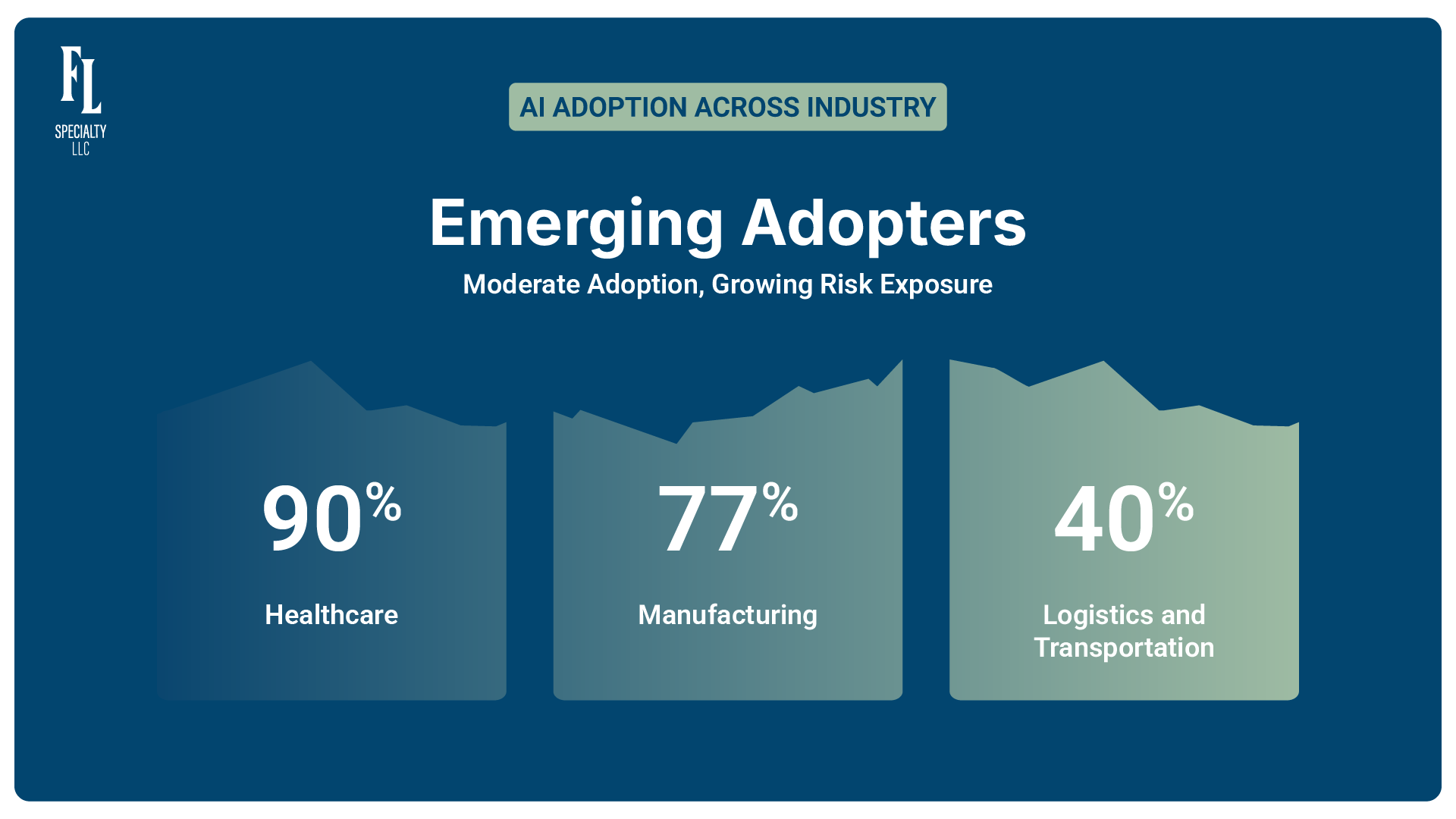

Emerging Adopters (Moderate Adoption, Growing Risk Exposure):

Healthcare: By 2025, 90% of hospitals are expected to use AI for predictive analytics and diagnostics—introducing new questions around malpractice and AI-assisted decision liability.¹⁰

Manufacturing: AI adoption hit 77% in 2024 (up from 70% in 2023), driving efficiency in inventory and production. But with it comes increased exposure to automation failures and product liability.¹¹

Logistics and Transportation: Predictive maintenance powered by AI has cut downtime by 40%. Yet greater automation introduces risks tied to autonomous failures and supply chain disruptions.¹²

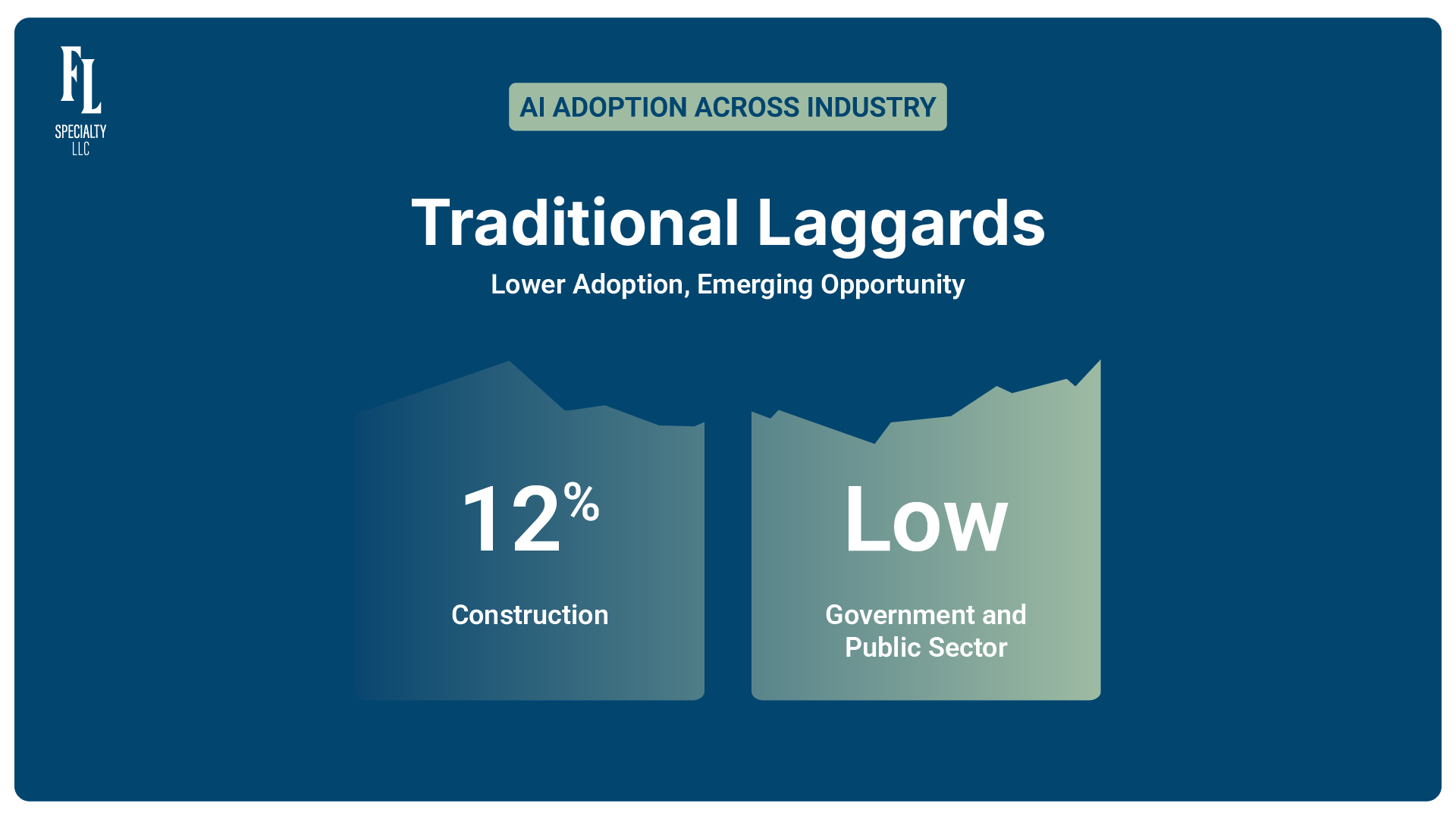

Traditional Laggards (Lower Adoption, Emerging Opportunity):

Construction: With just 12% AI adoption, the industry remains fragmented. But that low baseline signals a huge opportunity for risk innovation in safety, project planning, and cost prediction.¹⁴

Government and Public Sector: Regulatory complexity continues to slow adoption. But insurers are well-positioned to develop solutions around AI governance, compliance, and public-sector liability.

AI and Risk Management: The Insurance Industry’s Strategic Opportunity

Insurance has always evolved alongside innovation—protecting maritime voyages in the 1600s and enabling modern-day cyber coverage. Now, with AI transforming every industry, insurers have a new role to play: not just adapting operations, but actively shaping how businesses manage AI-driven risk.

Legacy Integration = New Risk Categories

Most industries aren’t starting from scratch—they’re integrating AI into aging infrastructure. According to McKinsey, digital leaders grow 5x faster and are 8x more profitable, yet only 40% of companies have successfully scaled digital initiatives.¹⁵

This gap creates a market for insurance products that cover AI integration failures, system disruptions, and adoption risks.

Regulatory Complexity Spurs Demand

As AI regulations evolve, organizations need support navigating compliance, liability, and governance—particularly in sectors like healthcare, finance, and government. Insurers who move fast can offer solutions before mandates become pain points.

The Rise of AI-Specific Coverage

We’re in the early innings of AI—much like the internet in the late 1990s. Just as no one predicted Amazon’s rise from bookstore to tech titan, today’s AI innovators will unlock new risks that require new categories of coverage.

From AI-assisted diagnostics to autonomous shipping networks, insurers who understand sector-specific exposures will lead the way in enabling safe adoption.

The Fall Line Advantage: AI Market Intelligence for Strategic Growth

The rapid evolution of AI across industries presents an unprecedented opportunity for insurers—but also immense complexity. Success demands more than operational efficiency. It requires a deep understanding of how AI is reshaping risk profiles across sectors and the ability to anticipate emerging exposures before they scale.

At Fall Line Specialty, our Product Design and Development services equip insurers with the market intelligence, analytics, and strategic frameworks they need to capitalize on this transformation.

AI Risk Assessment and Product Development:

Comprehensive analysis of emerging AI risks across target industries

Development of AI-specific underwriting criteria and pricing models

Creation of innovative coverage solutions for new technology exposures

Rapid market entry strategies for emerging AI insurance segments

Market Opportunity Identification:

AI-powered analytics to identify high-growth market segments

Competitive landscape mapping for AI-related insurance products

Partnership facilitation with AI companies and technology providers

Risk assessment capabilities that enable first-mover advantages

Strategic Intelligence and Positioning:

Real-time monitoring of AI adoption trends across industries

Regulatory development tracking and compliance impact analysis

Competitive intelligence on AI-related insurance innovations

Strategic positioning advice for capturing emerging market share

Unlike firms focused solely on AI implementation within insurance operations, Fall Line specializes in helping insurers understand and capitalize on AI’s transformation of the broader marketplace. By combining deep insurance expertise with cutting-edge AI analytics, we empower insurers to identify opportunities, assess emerging risks, and develop winning strategies to lead in the AI economy.

Looking Forward: The Next Insurance Innovation Cycle

We’re standing at the edge of the next great insurance innovation cycle. The question for insurance leaders isn’t whether AI will create new market opportunities—it’s which organizations will define and lead them.

The insurers that emerge as AI-era leaders will be the ones who:

Understand AI adoption patterns across target industries

Develop innovative products addressing new AI-related risks

Build capabilities to assess and price emerging technology exposures

Establish strategic partnerships with AI ecosystem participants

Create value-added services that enable safe AI adoption

History is instructive: from the industrial revolution to the internet age, transformative technologies have always created new risks—and with them, new insurance markets. The insurers who anticipated change and responded with innovative solutions consistently captured outsized market share and long-term relevance.

Today, AI and risk management represent the next great frontier. The insurers who recognize this reality and act decisively will shape not only their own futures but the future of the industry itself.

The opportunity is here. The only question is: will you lead—or follow?

Ready to identify and capitalize on AI-driven market opportunities? Contact Fall Line Specialty to learn how our Strategic Underwriting Operations can help your organization develop winning strategies for the AI economy.

Next Up…

See how AI-driven risk insights translate into new products, smarter portfolios, and first-mover advantage.

References

The Mobile Century. "How 30 years of internet access have changed everything from healthcare to finance." April 23, 2022. https://themobilecentury.com/how-30-years-of-internet-access-have-changed-everything-from-healthcare-to-finance/

Finbold. "Dot-com Bubble Explained | Story of 1995-2000 Stock Market." March 21, 2025. https://finbold.com/guide/dot-com-bubble-crash/

McKinsey & Company. "The state of AI: How organizations are rewiring to capture value." March 12, 2025. https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

History of the Internet. Wikipedia. June 6, 2025. https://en.wikipedia.org/wiki/History_of_the_Internet

Internet Usage Statistics. Scoop Market. January 14, 2025. https://scoop.market.us/internet-usage-statistics/

The Mobile Century. "How 30 years of internet access have changed everything from healthcare to finance."

Mezzi. "AI Adoption Rates by Industry: Trends 2025." May 14, 2025. https://www.mezzi.com/blog/ai-adoption-rates-by-industry-trends-2025

Coherent Solutions. "2025 AI Adoption Across Industries: Trends You Don't Want to Miss." 2025. https://www.coherentsolutions.com/insights/ai-adoption-trends-you-should-not-miss-2025

Warmly. "30+ Powerful AI Agents Statistics In 2025: Adoption & Insights." 2025. https://www.warmly.ai/p/blog/ai-agents-statistics

Warmly. "30+ Powerful AI Agents Statistics In 2025: Adoption & Insights."

Hypersense Software. "2024 AI Growth: Key AI Adoption Trends & ROI Stats." January 31, 2025. https://hypersense-software.com/blog/2025/01/29/key-statistics-driving-ai-adoption-in-2024/

Warmly. "30+ Powerful AI Agents Statistics In 2025: Adoption & Insights."

Vention Teams. "AI Adoption Statistics 2024: All Figures & Facts to Know." 2025. https://ventionteams.com/solutions/ai/adoption-statistics

Vention Teams. "AI Adoption Statistics 2024: All Figures & Facts to Know."

TDAN. "Digital Transformation in Insurance: Overcoming Legacy Challenges." 2025. https://tdan.com/digital-transformation-in-insurance-overcoming-legacy-challenges/32345

Additional Reading

Harvard Business Review. "How 6 Companies Approached Digital Transformation." June 20, 2025. https://hbr.org/2025/06/how-6-companies-approached-digital-transformation

Harvard Business Review. "Discovery-Driven Digital Transformation." May 1, 2020. https://hbr.org/2020/05/discovery-driven-digital-transformation

Prosci. "Digital Transformation in the Insurance Industry: A Change Management Guide." June 17, 2025. https://www.prosci.com/blog/digital-transformation-in-insurance-industry

Boston Consulting Group. "AI Adoption in 2024: 74% of Companies Struggle to Achieve and Scale Value." October 2024. https://www.bcg.com/press/24october2024-ai-adoption-in-2024-74-of-companies-struggle-to-achieve-and-scale-value