5 Key Trends of AI in the Insurance Industry Leaders Can’t Ignore

Believe it or not, when CNBC, Silicon Valley, and even the Department of Defense talk about AI, they’re not debating “additional insureds.” Artificial intelligence is here—like it or not. Whether you see it as the beginning of humanity’s downfall or the tool that might just save us from ourselves, one thing is certain: ignoring it isn’t an option. AI is transformative. And for anyone working in or around AI in the insurance industry, capturing its benefits—or protecting against its risks—starts with understanding how it’s reshaping the world around us.

All Gas, No Break.

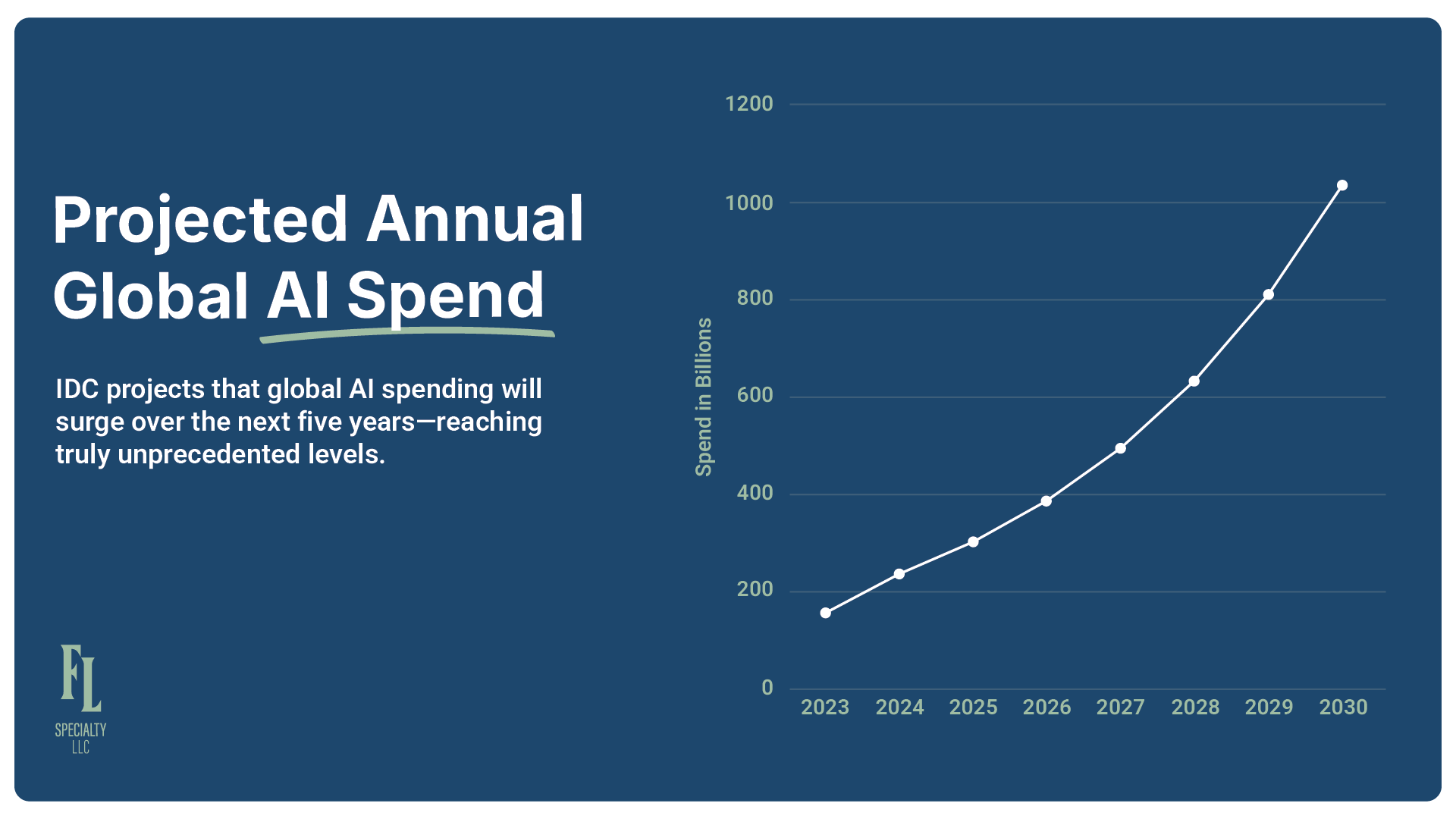

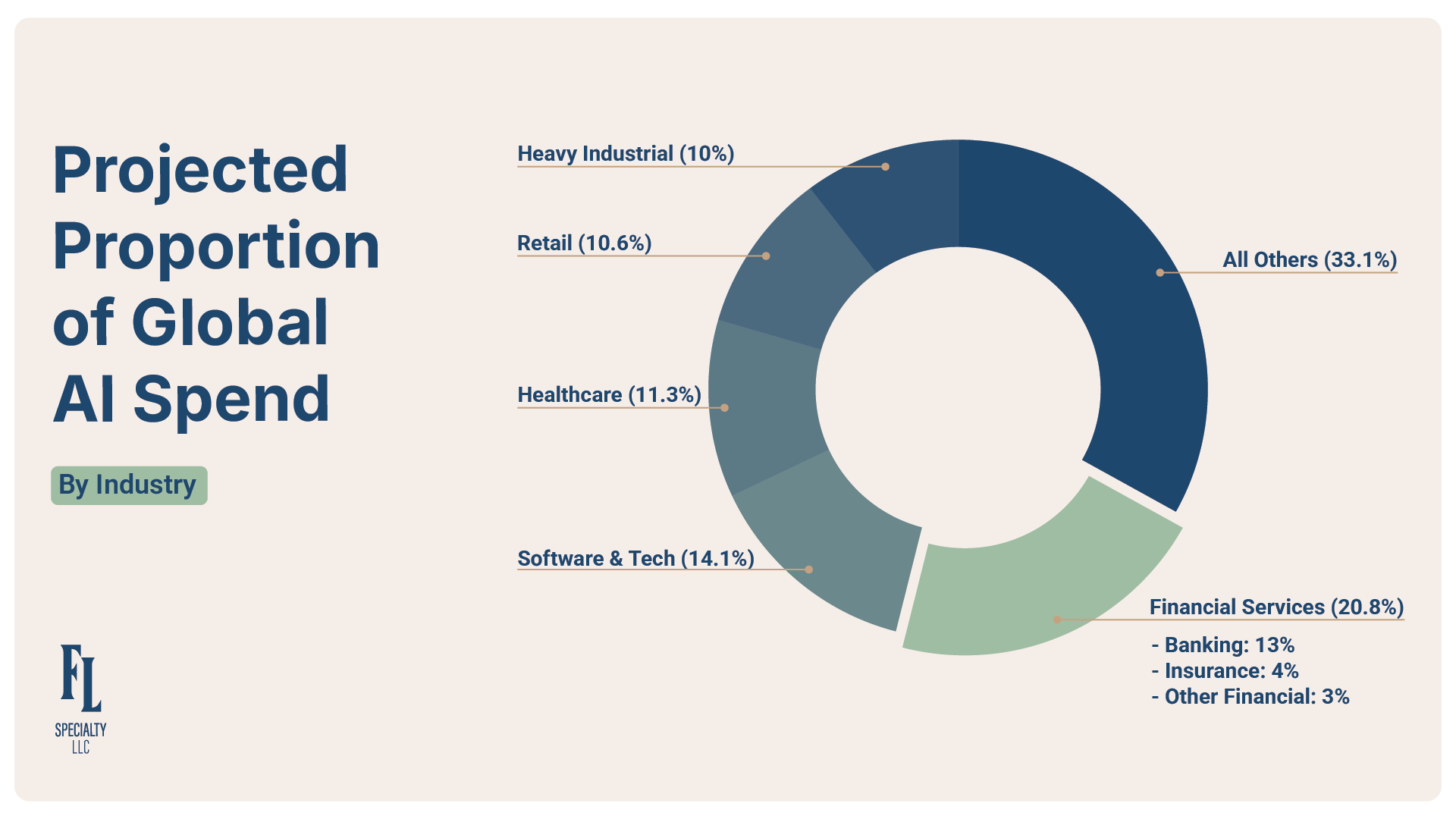

As companies and countries race to dominate the future of AI, IDC projects that global AI spending will surge over the next five years—reaching truly unprecedented levels. And it’s easy to see why. Leaders view AI not just as a tool, but as a strategic advantage—with stakes that stretch from short-term profitability to long-term global influence.

For better or worse, investment in AI is accelerating. Slowing down isn’t on the table.

Adoption in the Insurance Industry

Insurance has always had a complicated relationship with technology. We're historically cautious adopters—slower to embrace innovation than other industries. That hesitation isn’t without reason: the stakes are high, compliance is complex, and customer trust is hard-won and easily lost.

Still, the pressure is mounting. 77% of insurance executives say they need to adopt generative AI quickly to keep pace with competitors, and industry investment in AI is projected to grow more than 300% between 2023 and 2025.

The question isn’t whether AI will transform the insurance industry—it’s which developments will matter most to how we assess risk, serve clients, and operate more efficiently.

When it comes to AI in the insurance industry, five key breakthroughs are already reshaping the landscape. Understanding them isn’t just about keeping pace with change—it’s about positioning your agency or firm to lead in an AI-powered future.

The Big Five AI Developments

Agentic AI: Autonomous processes that not only execute tasks but also continuously improve themselves are now within reach. How this will apply in insurance is still unfolding, but the potential is enormous.

Proactive Risk Management: The “holy grail” of insurance has always been preventing losses before they occur. With predictive AI, this goal is closer than ever.

Mind the Gap: Every new technology creates gaps—and opportunities. As emerging technologies give rise to new business models, forward-thinking insurers can develop policies that don’t just catch up—they lead.

The Other Debt Crisis: Legacy systems are becoming a liability. The faster technology accelerates, the more costly it becomes to cling to outdated platforms—especially when it comes to data quality, access, and agility in an AI world.

The People Problem: The biggest barrier to transformation isn’t tech—it’s people. Change management remains the most difficult part of adopting AI in the insurance industry. Teams respond to change differently, and success will depend on leaders who combine strategic vision with empathy, clarity, and creativity.

Moving Forward

Each of these areas deserves deeper discussion, but the key takeaway is this: Each of these areas deserves deeper discussion, but the key takeaway is this: AI will profoundly impact not only insurance, but society at large. While caution is wise, waiting too long is not.

The winning strategy? Balance urgency with responsibility. Push, test, learn, and adapt—while putting the right safeguards in place. Those who hesitate risk falling behind, getting outflanked, or worse: becoming irrelevant.

This isn’t just hyperbole or marketing. Speaking from first hand experience, our team has consistently been amazed at the pace of change, the new tools emerging daily, and the real impact AI is already having. From individuals, to small teams, AI is enabling roles in a host of different functions from marketing to merchandising. As individuals, teams and eventually companies begin to adapt and leverage these tools, their ability to capitalize on them will grow—creating a fortuitous cycle that can become a competitive advantage.

This is why embracing even a few of these opportunities is so critical. The longer companies wait, the harder it will be to catch up.

Strategic Implications for Insurance Leaders

These five AI forces aren’t isolated—they’re interconnected trends reshaping the competitive landscape of AI in the insurance industry. Organizations that anticipate and adapt will gain an edge in efficiency, responsiveness, and customer satisfaction.

At Fall Line Specialty, we don’t just talk about AI—we deliver it. Our team brings more than 100 years of combined insurance leadership experience, paired with deep expertise in AI, data science, and advanced technology platforms. We built our organization with AI at the core—not as an afterthought.

Unlike tech-first companies trying to learn insurance, we’re insurance experts who have mastered technology. That’s why we’re uniquely positioned to help you navigate this transformation—strategically, responsibly, and with impact.

Ready to lead the way in AI-driven insurance? Let’s get to work.

Ready to Move Forward?

Don’t wait for the future of insurance—help create it.

Contact Fall Line Specialty today to learn how we can help you harness AI’s potential while managing its risks and implementing it successfully.

Next Up…

Ready to move from high-level AI trends to real execution? Explore where risk, capital, and opportunity intersect next.