AI in Insurance: What Internet Investment Patterns Reveal About The Future

The AI race isn’t slowing down. In 2025 alone, tech giants are set to invest over $300 billion in artificial intelligence, with Amazon committing a staggering $100 billion. As CEO Andy Jassy puts it, Gen AI is “the biggest technological shift since the internet.”¹

If that sounds familiar, it should. This surge echoes the late-90s internet boom, when telecom companies poured more than $500 billion—mostly financed with debt—into building the digital infrastructure we now take for granted: fiber optic cables, switches, and wireless networks.²

For commercial property and casualty insurance leaders, this isn’t just an interesting headline, it’s a strategic signal. The decisions you make today will determine where you stand tomorrow— whether you pull ahead as an industry leader for AI in insurance or spend the next decade playing catch-up in an increasingly competitive landscape.

So the real question is: will you ride this wave—or risk being left behind?

Lessons for AI in Insurance from the $1.7 Trillion Internet Boom

To understand where AI is headed, it helps to look back at the internet revolution. During the dot-com era, the NASDAQ soared 582% between 1995 and 2000, fueled by massive capital flows and investor enthusiasm.³ But here’s what many organizations missed: the companies that won weren’t necessarily the ones that spent the most—it was those that placed strategic bets in the right places.

When the bubble burst, it looked like much of that investment had been wasted. Telecom companies were left with overbuilt infrastructure and excess capacity. But in reality, those “wasteful” investments became the foundation for the next wave of innovation. Affordable high-speed internet paved the way for companies like Google, Amazon, and Facebook to emerge and define the next era of digital growth.⁴

The insurance industry faces a similar moment. Not every dollar being poured into AI today by tech giants, investors, and governments will deliver immediate breakthroughs. But the infrastructure being built right now—from data capabilities to intelligent automation—will shape where competitive advantages emerge tomorrow.

The lesson is clear: the question isn’t whether to invest in AI in insurance—it’s where and how to invest strategically.

AI in Insurance Investment Will Take Many Forms

While today’s AI investment patterns echo the internet era, the stakes are higher and the timelines are shorter. Global spending on AI-centric systems—including software, hardware, and services—is projected to grow from $118 billion in 2022 to $300 billion by 2026. That’s a 26.5% compound annual growth rate—nearly four times faster than overall IT spending.⁵

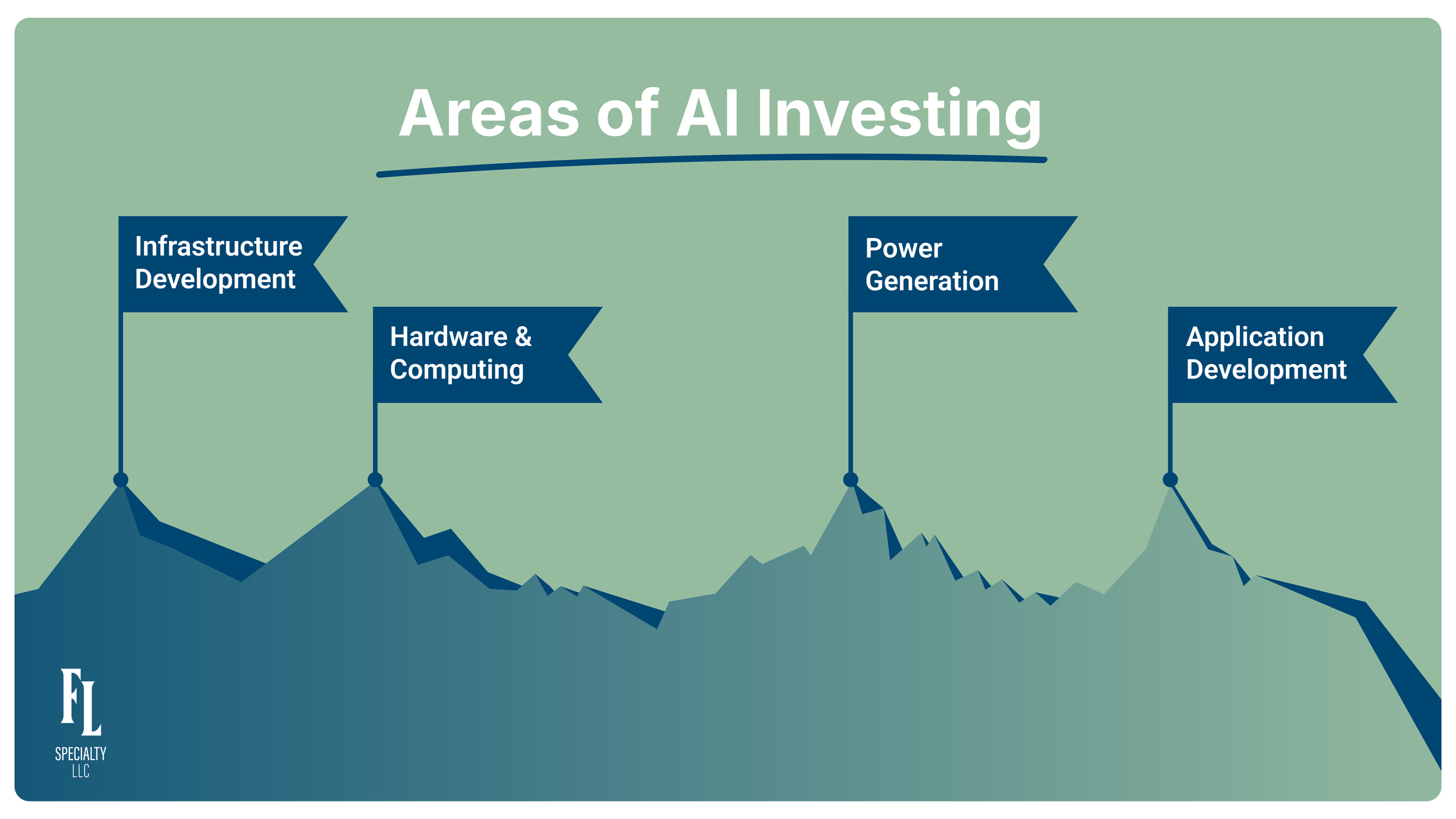

But where is all that capital actually going? Today’s AI in insurance investment wave is splintering across four critical fronts:

Infrastructure Development: Tech giants are building the backbone of AI: data centers, computing power, and core AI models. Meta alone projects $60–65 billion in AI spending for 2025, with long-term investments climbing into the hundreds of billions.

Hardware and Computing: The race for AI-ready hardware is fueling massive investments in semiconductors, specialized chips, and high-performance computing infrastructure.

Power Generation: Unlike the internet boom, AI comes with enormous energy demands, driving new investments in power generation, grid capacity, and sustainability strategies.

Application Development: This is where industries like insurance face the greatest opportunity and risk: developing AI-driven applications tailored to transform underwriting, claims, and customer experience.

For P&C carriers, brokers, and insurance professionals, these investment patterns point to a clear reality: AI adoption won’t be as simple as rolling out Copilot to your team and calling it a day. It’s not just about implementing new tools—it’s about reimagining products, services, and business models from the ground up.

In other words, AI isn’t just new technology for the insurance industry. It’s the next era of innovation and competitive advantage.

How to Apply AI in Insurance

The pace of change is staggering. AI is advancing faster than any other technological shift in history—and for many organizations, knowing where and how to start can feel overwhelming. Before jumping on the AI train, it’s critical to pause, assess your needs, and chart a deliberate path forward.

Here’s what to consider:

Focus Wins Out: The internet era taught us an important lesson: simply having a website wasn’t transformative—it was reimagining customer relationships through connected, digital experiences that drove lasting value. AI is no different. Organizations that prioritize one or two core areas—underwriting, claims processing, customer service, or sales—and reimagine those processes with AI are far more likely to see meaningful results.⁷

Process Transformation Over Tool Adoption: Buying tools is easy. Driving outcomes is harder. There’s no shortage of vendors eager to sell you “AI-enabled” products and promise remarkable benefits. But technology alone won’t deliver competitive advantage—it’s the combination of people, process, and technology that creates lasting impact. Without rethinking workflows, the tool benefits the software company, not you.

Speed of Implementation: Traditionally, the insurance industry has taken a cautious approach to adopting new technology. But with AI, the window for competitive advantage is short. McKinsey projects a potential $4.4 trillion productivity boost from AI adoption globally,⁹ and every new model release or industry partnership only accelerates what’s possible. Acting now, and acting strategically matters.

With all signs pointing to AI in insurance, it’s time to lean in. But you don’t need an Amazon-sized investment to compete. Small, targeted investments can set your organization on the right trajectory and ensure you’re building capabilities today that will define tomorrow’s leaders.

Insurance Businesses Are Always Placing Bets, Why Should AI be Different

In the internet era, the companies that won didn’t succeed by making the biggest investments. They succeeded by making the right investments at the right time. The same is true today with AI. For insurance leaders, success will come from identifying high-impact focus areas—and avoiding common pitfalls.

High-Impact Focus Areas:

Underwriting Operations: AI work with U.S. and U.K. commercial P&C insurers shows that augmenting manual underwriting processes can improve efficiency by up to 36%.¹⁰

Claims Processing: For complex claims, AI-powered applications—like first-notice-of-loss data extraction, document processing, and smart triaging—are delivering cost reductions of up to 20% and claims processing speeds up to 50% faster.¹¹

Customer Service: In BCG studies involving more than 20,000 insurance operations employees, AI-assisted tools boosted productivity by more than 30%.¹²

Investment Risks to Avoid:

Spreading Resources Too Thin: Trying to implement AI across too many functions at once dilutes impact and slows results.

Chasing Tools, Not Transformation: Technology alone doesn’t drive outcomes—process change does.

Underestimating Human Change Management: Successful AI adoption requires aligning people, processes, and culture—not just buying software.

The Fall Line Advantage: Partnership, Depth and Results

Insurance businesses are already juggling a lot—modernizing operations, managing tech debt, revitalizing products. And while the pressure to innovate is real, AI in insurance can easily become another distraction without a clear strategy.

At Fall Line Specialty, we offer a different path. Our Strategic Underwriting Operations approach gives insurance companies access to enterprise-level AI transformation—without the massive capital investment or implementation risk. Instead of building internal AI capabilities from scratch, our clients leverage our proven, AI-enhanced operations to achieve measurable results in weeks, not months.

We take on the operational risk and technology investment burden so you can stay focused on what creates the most value for your business: strategic growth, stronger partner relationships, and market expansion.

It’s the same playbook the most successful companies used during the internet era: they focused on their core value propositions while leveraging infrastructure built by others. With Fall Line, you can do the same—accelerate innovation without slowing down your business.

Your Game Plan - Strategic Patience, then Decisive Action

The internet investment cycle taught us a critical lesson: timing matters as much as the size of the investment. Take Amazon, for example. When the dot-com bubble burst, Amazon didn’t retreat—it continued to grow aggressively while also controlling costs and diversifying its business model. Those early bets on technology infrastructure ultimately laid the foundation for its future dominance, including the rise of Amazon Web Services.¹³

For insurance leaders, the takeaway is clear: success in the AI era requires a dual strategy—strategic patience about long-term development, paired with decisive action on near-term capabilities. The companies that will lead the next decade will be those that:

Invest with Purpose: Focus AI spending on solving meaningful business problems, not chasing shiny tools.

Stay Adaptable: Build flexible operational models that evolve alongside rapidly advancing AI capabilities.

Partner Strategically: Leverage external expertise to access AI capabilities without assuming unnecessary implementation risk.

Stay Value-Focused: Keep your eye on business outcomes and avoid getting swept up in technology hype.

The winners won’t be those who spend the most, but those who move deliberately, act decisively, and place their bets where they matter most.

The Road Ahead

The AI investment surge of 2025 will likely look modest compared to what’s coming next. But as the internet era taught us, the winners won’t be those who spend the most—they’ll be the organizations that apply transformative technology strategically to build sustainable competitive advantages.

For commercial P&C insurance professionals, the opportunity is clear: AI in insurance will reshape how companies operate, compete, and create value. It will also transform other industries, creating entirely new markets and products. The question isn’t if this transformation will happen—it’s whether your organization will be positioned to capitalize on it.

The insurers who thrive in this next era will be the ones who practice smart capital allocation, focused implementation, and strategic partnerships. The lesson from the internet revolution is simple: the time for strategic AI planning is now—before the competitive landscape hardens.

The great capital rush is already underway. How your organization navigates it will define your competitive position for the next decade—and beyond.

Want to assess your organization's AI readiness without massive capital risk? Contact Fall Line Specialty to learn how our Strategic Underwriting Operations can accelerate your AI transformation while we assume the implementation risk and technology investment burden.

Next Up…

Turn macro investment signals into a practical roadmap for AI in your organization.

References

Yahoo Finance. "Tech Giants Pour $300 Billion into AI as Investment Race Heats Up." February 7, 2025. https://finance.yahoo.com/news/tech-giants-pour-300-billion-114234953.html

Wikipedia. "Dot-com bubble." Accessed July 2025. https://en.wikipedia.org/wiki/Dot-com_bubble

Corporate Finance Institute. "Dotcom Bubble - Overview, Characteristics, Causes." December 7, 2023. https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/dotcom-bubble/

Wikipedia. "Dot-com bubble." Accessed July 2025. https://en.wikipedia.org/wiki/Dot-com_bubble

Business Wire. "Worldwide Spending on AI-Centric Systems Will Pass $300 Billion by 2026, According to IDC." September 12, 2022. https://www.businesswire.com/news/home/20220912005203/en/

Boston Consulting Group. "How Insurers Can Supercharge Their Strategy with AI." April 15, 2025. https://www.bcg.com/publications/2025/how-insurers-can-supercharge-strategy-with-artificial-intelligence

Boston Consulting Group. "How Insurers Can Supercharge Their Strategy with AI." April 15, 2025.

McKinsey & Company. "The future of AI for the insurance industry." July 2025. https://www.mckinsey.com/industries/financial-services/our-insights/the-future-of-ai-in-the-insurance-industry

McKinsey & Company. "AI in the workplace: A report for 2025." January 28, 2025. https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/superagency-in-the-workplace-empowering-people-to-unlock-ais-full-potential-at-work

Boston Consulting Group. "How Insurers Can Supercharge Their Strategy with AI." April 15, 2025.

Boston Consulting Group. "How Insurers Can Supercharge Their Strategy with AI." April 15, 2025.

Boston Consulting Group. "How Insurers Can Supercharge Their Strategy with AI." April 15, 2025.

Finbold. "Dot-com Bubble Explained | Story of 1995-2000 Stock Market." March 21, 2025. https://finbold.com/guide/dot-com-bubble-crash/

Additional Reading

McKinsey & Company. "The state of AI: How organizations are rewiring to capture value." March 12, 2025. https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

Goldman Sachs. "The Late 1990s Dot-Com Bubble Implodes in 2000." April 5, 2019. https://www.goldmansachs.com/our-firm/history/moments/2000-dot-com-bubble

Britannica Money. "Dot-com Bubble & Bust | Definition, History, & Facts." https://www.britannica.com/money/dot-com-bubble

Insurance Business America. "Chubb exploring artificial intelligence, preparing for rollout 'at scale'." April 27, 2023. https://www.insurancebusinessmag.com/us/news/breaking-news/chubb-exploring-artificial-intelligence-preparing-for-rollout-at-scale-444144.aspx