What Insurance Business Intelligence Reveals About Carrier Appetite

“AI helped me identify which carriers would be most receptive to my submissions before I even sent them.”

That statement would have sounded unrealistic just a few years ago. Today, it’s becoming a competitive reality for brokers who understand how to use insurance business intelligence the right way.

Most wholesale brokers don’t struggle because they lack markets. They struggle because they lack visibility—visibility into which carriers will actually engage, quote competitively, and bind a specific risk right now.

Insurance business intelligence is changing that.

The Gap Between Stated Appetite and Actual Behavior

Most brokers understand carrier appetite in theory. In practice, appetite is fluid. It changes with portfolio performance, capacity pressure, leadership decisions, and even the calendar.

Yet many placement strategies still depend on static guidelines or informal market knowledge. Submissions go to familiar carriers, timing is largely incidental, and declines are treated as inevitable rather than informative.

The result is a reactive workflow. Insurance business intelligence offers a way to replace that reactivity with intention.

What Insurance Business Intelligence Looks Like in Practice

Modern insurance business intelligence is not about dashboards for the sake of reporting. It is about learning from outcomes.

When submission data is analyzed over time—quotes, declines, binds, pricing behavior, and timing patterns—it begins to tell a story about how carriers actually operate. Patterns emerge that no individual broker could reasonably track manually, especially at scale.

Instead of asking which carriers should quote a risk, brokers can start asking which carriers have historically performed well for similar risks under similar conditions.

That shift changes how placements are made.

A Broker’s Turning Point

One wholesale broker specializing in construction risks reached a familiar plateau. With 200+ submissions moving through the market each month and nearly 50 carrier relationships, placements were steady but inefficient. Hit rates remained stubbornly low at 23%, and timing issues often undermined otherwise solid submissions.

Rather than expanding the market list, the broker looked inward.

Two years of historical placement data were analyzed using AI to surface behavioral patterns across carriers. What emerged wasn’t obvious—but it was actionable.

Certain carriers showed clear seasonal preferences, shifting appetite based on quarterly cycles. Others consistently priced better for accounts with specific safety credentials, regardless of overall account size. Geographic expansion and contraction became visible months before it appeared in appetite guidance.

This is where insurance business intelligence moved from concept to capability.

From Insight to Execution

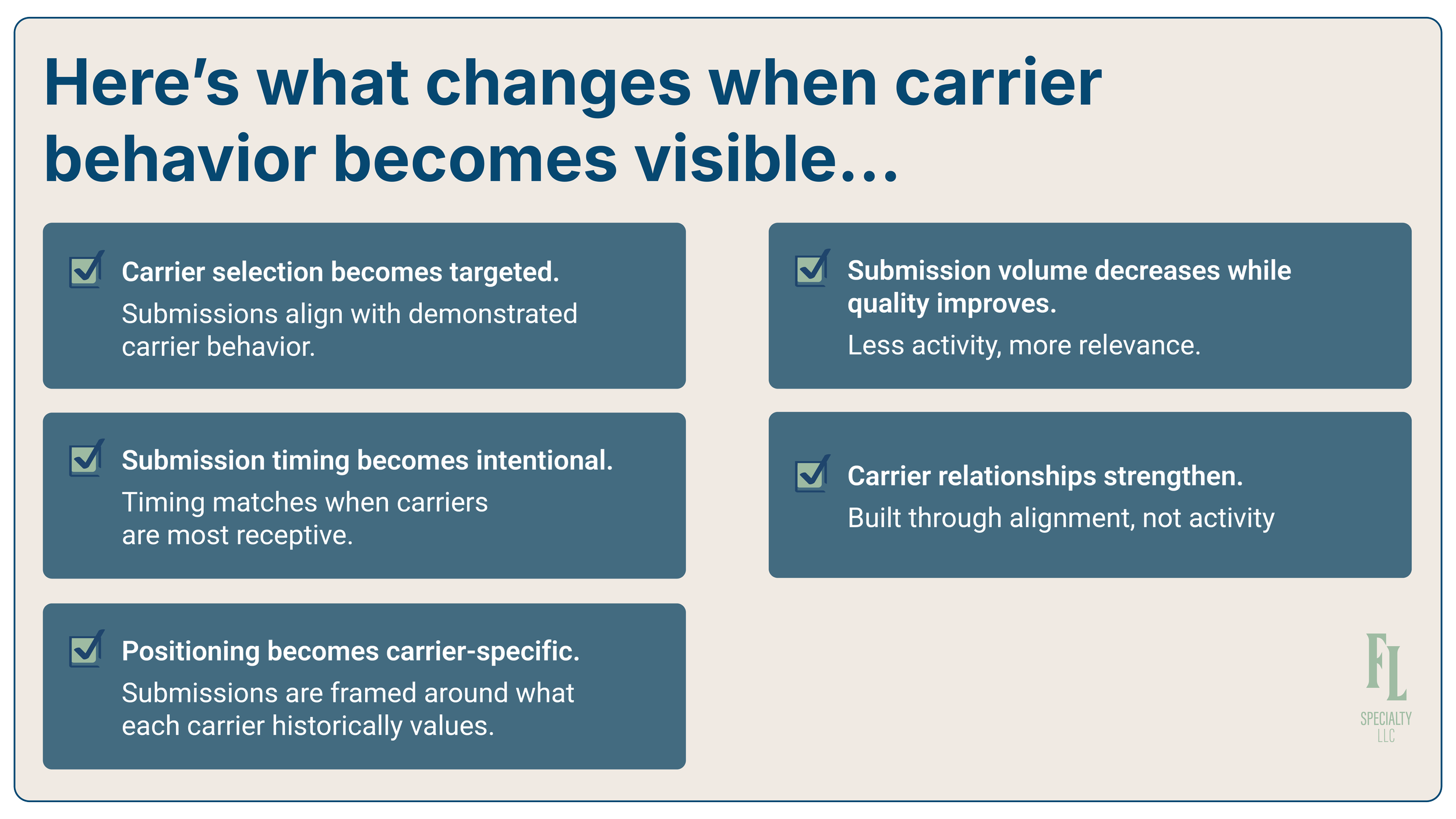

With greater visibility into carrier behavior, the broker changed how submissions were approached.

Carrier selection became more targeted, reducing wasted submissions by approximately 67%. Timing shifted from incidental to intentional, improving quote competitiveness by roughly 45%. Submissions were positioned around what each carrier historically valued, contributing to an 89% increase in quote-to-bind performance over time.

Fewer submissions were sent, but more of them mattered. Relationships strengthened—not through volume, but through alignment.

Insurance business intelligence didn’t replace broker judgment. It sharpened it.

Why Outcomes Improve When Brokers Use Their Own Data

Every submission outcome carries information. A decline signals more than a “no.” A quote reveals pricing appetite. A bind reflects alignment between risk, timing, and carrier priorities.

Individually, those signals are easy to dismiss. Collectively, they form a powerful dataset.

Insurance business intelligence treats placement history as a learning system. It reveals where carriers are expanding or pulling back, how timing affects competitiveness, and which relationships are compounding value over time.

AI simply accelerates the learning process by identifying patterns humans can’t reliably detect on their own.

The Competitive Shift Underway

The wholesale market is becoming less forgiving of inefficiency. Clients expect speed, clarity, and confidence. Brokers who understand carrier behavior at a granular level are better equipped to deliver all three.

Insurance business intelligence changes the fundamental placement question from who might respond to who is most likely to perform well for this risk right now.

That difference defines the next generation of market leaders.

Final Thought

Your submission history already contains the answers most brokers are searching for. Insurance business intelligence is what allows you to uncover them.

The real question isn’t whether the data exists—it’s whether you’re using it.

And if not, how many of today’s declines are simply the result of sending good risks to the wrong carriers at the wrong time?

Curious where the “wasted submissions” are hiding in your workflow?

Fall Line can help you surface carrier patterns from your own outcomes and tighten your placement strategy fast. Let’s talk.

Want to go deeper? If you’re thinking about how data + AI can sharpen placement strategy and reduce wasted submissions, these are worth a read next: