The Power Tool Problem: Making Insurance AI Tools Work for You

Recently, I bought a new chainsaw. It’s battery-powered, quiet, and efficient—everything you’d want in a modern tool. Naturally, I wanted to use it on everything in sight. The problem? Not every task needs a chainsaw.

That’s the same dynamic playing out across the insurance industry today. Everyone’s racing to deploy ChatGPT, Claude, and every new model that hits the market without first asking the most important question: what’s the right tool for the job?

In the rush to experiment, insurers are often overlooking the real opportunity. It’s not about having more insurance AI tools; it’s about knowing how, where, and why to apply them. The difference between value and chaos comes down to precision.

Because when it comes to underwriting, claims, or policy administration, the wrong tool doesn’t just slow you down, it creates new risks. Operational risks. Compliance risks. Reputational risks.

So, how can insurers separate experimentation from execution and start using AI responsibly and effectively? Read on to learn more.

Making Insurance AI Tools Work for You

Insurance AI tools are powerful—no one’s disputing that. But just because you can use them everywhere doesn’t mean you should. Like a chainsaw, they’re designed for specific, high-impact jobs—not for trimming hedges or fine woodworking.

Across the industry, insurers are rushing to deploy AI without first evaluating whether they’ve fully leveraged the tools already at their disposal. Before investing hundreds of thousands into AI infrastructure, it’s worth asking a more fundamental question: Have you maximized what you already own? Your Excel models. Your CRM. Your data warehouses. Your policy admin systems.

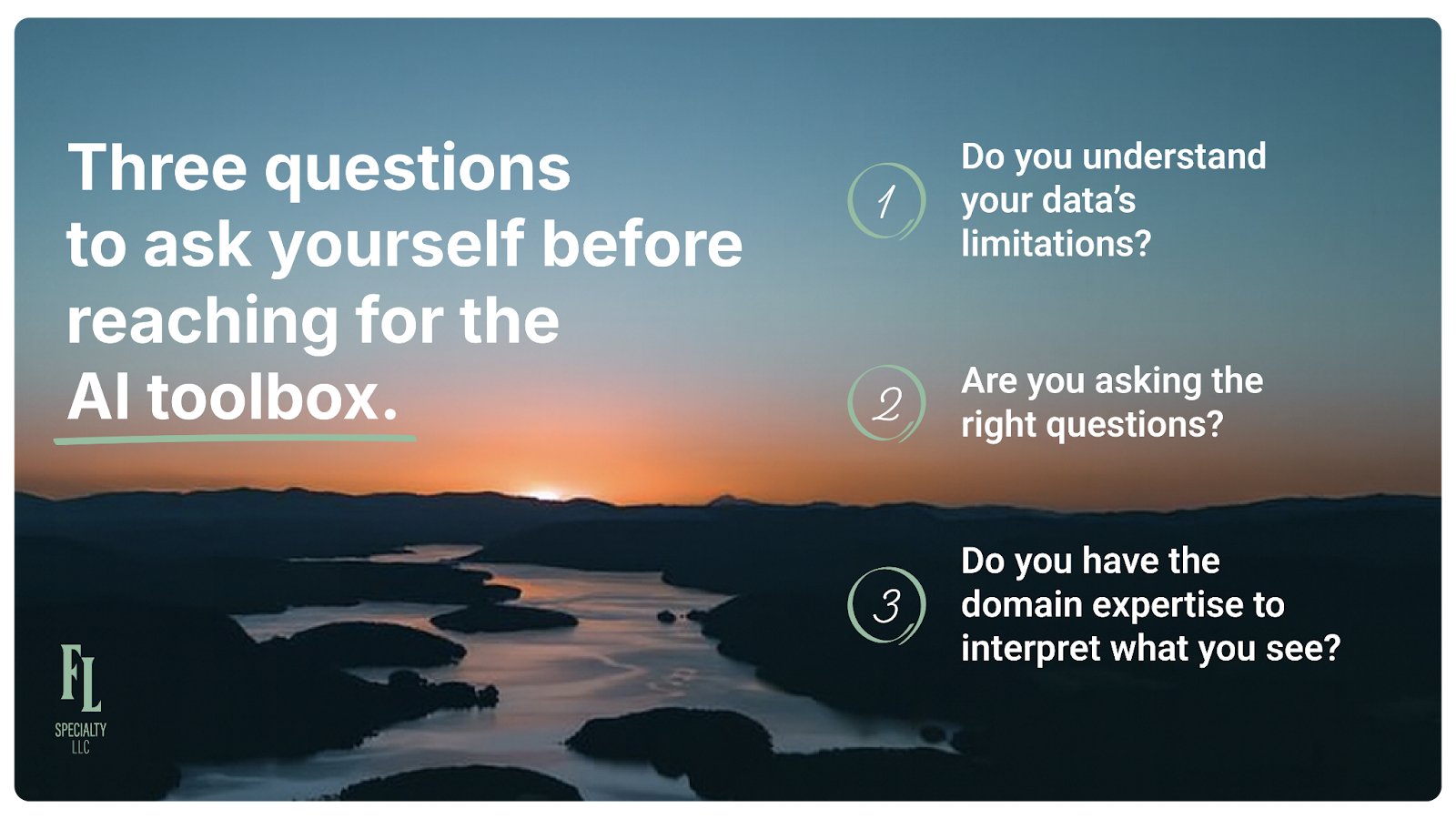

Here’s the uncomfortable truth most executives don’t want to hear: many carriers already have tools that can deliver meaningful results with minimal additional cost or complexity. The problem isn’t capability—it’s creativity. Too often, teams chase new insurance AI tools while underutilizing the systems that could already solve 80% of their challenges. Here are three questions to ask yourself before reaching for the AI toolbox:

Do you understand your data’s limitations?

Messy, inconsistent, incomplete data isn’t unusual—it’s normal. But if you don’t know where your data is weak, even the most powerful tools will lead you to confident, incorrect conclusions.

Are you asking the right questions?

Too often, teams start with the tool instead of the problem. But AI doesn’t tell you what to solve—it just helps you solve what you already understand. Define the business question first. Then determine if AI is the right approach.

Do you have the domain expertise to interpret what you see?

AI can spot patterns, but it can’t explain seasonality, regulatory nuance, or structural quirks in your business. Someone has to know that Q4 always skews because of renewals—or that agent behavior changed after a commission structure shift in 2021. Without context, patterns are just noise.

At Fall Line, we’re insurance experts first. We bring the carpenter’s mindset: a deep understanding of the domain, fluency in insurance AI tools, and the judgment to know what matters. We know which questions to ask. We know which outputs are meaningful. And we know how to turn insights into operational action.

The Tools You're Ignoring

Before expanding your AI capabilities, take a hard look at the tools already in your stack. Are you truly maximizing Excel? Your CRM? Your internal data systems?

Because when it comes to portfolio analysis in insurance, these systems often hold more value than we give them credit for. Excel alone can surface cross-sell opportunities, run simulations on incentive design, and segment books of business in ways that immediately drive revenue. Your CRM can do far more than track call logs. Your collaboration stack can do more than ping someone when they're late to a meeting.

The uncomfortable truth is this: many insurance organizations already have the tools they need to generate serious value. They’re just not using them well. The data exists. The access exists. The opportunity exists. But instead of creative execution, we see clunky workarounds, siloed teams, and vendors brought in to fix what Excel could’ve handled in an afternoon.

That’s not a tooling issue, it’s a strategy issue.

Take portfolio analysis. Most teams use it to find renewal gaps or cross-sell targets. But what if you pushed it further? Add a compensation lens to model producer behavior. Layer tenure, claim frequency, and product mix to uncover accounts most likely to churn—or expand. Combine external data to assess how risk appetite and market dynamics intersect. These are questions you can answer today, using what you already have.

This isn’t about downplaying innovation. It’s about extracting full value from the tools you already own before reaching for new ones.

Why Organizations Chase Shiny Objects

If existing tools are so powerful, why do so many organizations chase the newest insurance AI tools? Three reasons stand out:

1. Tools are fun.

Let’s be honest: new platforms are exciting. Many of us in tech (myself included) love exploring what’s possible. At an individual level, that curiosity can be useful. At the organizational level, when shareholders are footing the bill, it becomes expensive and risky.

2. Boards want to hear “AI.”

Executive teams face real pressure to showcase innovation. “We’re focused on Excel” doesn’t exactly wow a board, even if it’s the smarter strategic play. That pressure cascades down the org and conveniently lines up with sales quotas for vendors.

3. Fear of falling behind.

The AI narrative is everywhere. Miss the wave, and you’re obsolete. But for most insurers, this fear is premature. AI will reshape the industry, but only for organizations that have already mastered the basics: clean data, clear business questions, and a track record of turning insights into operational change.

Put these forces together, and it’s easy to waste months testing tools, building prototypes, and generating more sawdust than substance.

At Fall Line, we focus on outcomes, not tech for tech’s sake. Because we understand the operations, we can move fast, implement in weeks, and deliver measurable results regardless of the tools in play.

Why AI Insurance Tools Need Maintenance, Not Just Implementation

Let’s go back to the chainsaw for a second. Buying the tool is just the beginning. A chainsaw needs bar oil. A charged battery. A place to store it. (I still think under the bed is hilarious—my wife strongly disagrees.) It needs sharpening, cleaning, and regular maintenance. And it’s not just about the tool, it’s about knowing what to cut, how to cut it, and how to do it safely.

Insurance AI tools are no different, except they require even more.

They need clean, structured, validated data.

They need governance frameworks to track usage, decision-making, and model accountability.

They need systems that can actually turn insights into actions—not just dashboards that look good.

Most importantly, they need people.

Large Language Models are easy to experiment with—but real, enterprise-grade AI and analytics in insurance demand much more. They require:

Data scientists who understand the math behind the model

Subject matter experts who can spot flawed logic in AI outputs

Change management experts who can embed those outputs into actual workflows

Here’s the uncomfortable truth: many insurers aren’t ready for advanced analytics. Not because the tools aren’t available. Not because the budget isn’t there. But because the fundamentals haven’t been built:

The data isn’t clean or connected

The organization isn’t trained to interpret and apply analytical outputs

The processes aren’t in place to drive decisions based on those insights

And that’s okay.

It’s far better to acknowledge that gap, and build the foundation, than to throw money at tools your business can’t operationalize.

Turning Tools into Results

If organizations focused on extracting 100% of the value from the tools and data they already have, they’d be surprised at how much progress they could make. Real insights. Real action. Real business outcomes—often within weeks, and at a fraction of the cost of a full-blown AI implementation.

It starts with an honest inventory:

What tools are already in place?

What data are you collecting?

What decisions are you trying to improve?

Then, ask the critical question: what’s the simplest tool that can help you get there?

Sometimes the answer will be an AI solution built for insurance. Often, it won’t be.

Sometimes it’ll be a well-structured Excel model.

Sometimes, tighter CRM discipline or clearer collaboration workflows.

Sometimes, it’s just better alignment between data, process, and execution.

The key is matching the tool to the task, not the other way around.

Carpenters don’t start with a tool and look for something to build. They start with a vision—then pick the right tools for that specific job. Insurance teams should approach innovation the same way: vision first, then technology.

And when the job does call for specialized expertise, whether it’s analytics, data engineering, or change management, bring in the right partner. Not a vendor selling buzzwords. A team that understands your business, speaks your language, and is equipped to turn ideas into outcomes.

At Fall Line, that's exactly who we are. We're carpenters, and we know insurance. We're insurance experts enhanced by AI, not technology seeking an industry. We deliver results over advice, speed over lengthy implementations, and guaranteed outcomes over hopeful projections. When you're ready to stop playing with tools and start building real value, we're here to help.

That’s how meaningful innovation happens in insurance. Not by chasing shiny objects, but by making smart, strategic decisions that connect insights to execution.

Next Up…

Stop chasing shiny tools—see how leading agencies align AI with real portfolio and workflow priorities.

Want to learn more about how Fall Line can help you translate insights into action and deliver measurable results? Visit us at falllinespecialty.com or reach out directly to start a conversation about your specific challenges.